The Essential Guide to Financing For Startups

Startup businesses need adequate funding to support operations. But there are a lot of myths around financing for startups that make the process more complex and prolonged than it needs to be.

For example, while most entrepreneurs assume venture capital will be their primary source of funding, only 6% of all startups actually receive anything from them. The good news is that, whether or not your company is part of that group, there are many financing options out there.

In this article, we’ll provide helpful information for startup business owners on managing their finances. We’ll also explain the various financing options available and what you can do to mitigate the threats to startup success along the way.

Keep reading to discover tips on how to create a winning strategy and responsibly manage financing for startups.

What is startup financing?

Startup financing is money that early-stage companies can use to launch their products or grow their businesses. There are various types of startup financing and are put into two categories: dilutive and non-dilutive . In financing for startups, these terms essentially describe the nature of ownership between the company and its financing partners.

Dilutive funding is a type of funding that requires you to give away a portion of your company. Some examples include venture capitalists and investors. These financing options require the participation of the investors for the company to be successful. These are often hands-on relationships with the VCs actively participating in operations at a high level.

In non-dilutive financing, startup owners get to keep complete control of their vision. This includes sources such as grants and loans. Regardless of how much funding they receive, startups have all the decision-making power in the relationship. Sounds great, right?

The catch is that getting the money you need can be challenging, especially since you’ll likely need a few different types of funding. Not only are these programs competitive, but they are also restrictive. Loan issuers will often have strict requirements that startups must change their business plan to accommodate. Losing sight of vision is a huge risk for owners who are trying to fit a mold others have created just to get their company off the ground.

That being said, non-dilutive financing can be a huge help in terms of keeping your company running smoothly while maintaining creative freedom. Because freedom is a significant selling point for entrepreneurs, it’s no surprise that recent hybrid models of non-dilutive financing have cropped up to make up for its disadvantages. For example, revenue sharing models allow boutiques to receive guaranteed loan payments taken directly from company profits.

We’ve listed a few examples already, but to fully understand your options i, you’ll have to familiarize yourself with the major categories of startup financing.

Startup financing options

Getting started with startup financing can be a challenging process. But it can be worth it if it helps your company start off on the right foot and avoid running into financial issues early on. Beat the odds with one or more of the following startup financing options all founders must know.

A crowdfunding campaign is an online platform where people give money to a company. In some cases, the crowdfunders exchange their money for an early product or service launch.

Crowdfunding is a growing industry. There are a number of platforms that will allow you to raise funds for different projects. Each platform has its own unique perks.

Platforms like Kickstarter allow companies to raise funds without having to pay for the platform or provide rewards. Equity crowdfunding is also a type of crowdfunding that allows backers to own a portion of a company.

Crowdfunding is generally low-risk. However, a failed campaign can cost you time and money.

A small business loan is typically secured by a business or personal loan. You may have to provide collateral or have a high credit score in order to get approved.

The Small Business Association is a great resource for finding a startup loan. Through its website, you can search for information about the organization and get started.

Unlike bank loans, microloans are unsecured. They can be offered to individuals with little or no credit history. The interest rates can vary.

There are plenty of advantages to getting a loan, but there are also some downsides. Besides owing money, founders have to account for accrued interest and how having loans may negatively impact their ability to fundraise in other ways.

An investor is someone who gives money to a business for the purpose of operating. The most coveted type of investor is an angel investor. An angel investor provides funds from their own company or personal accounts.

Angel investors typically expect a partial or full ownership stake in the company. Usually, they receive a payout based on the company's performance. When bringing on stakeholders, it’s important to consult with them before starting new projects .

To find an angel investor, first, create a business plan and pitch deck. This will help you stand out from the crowd and show the potential investor that you're serious about being a successful entrepreneur.

Unlike loans, grants are not required to be repaid. They're highly competitive and can provide immediate cash to boost your business.

Getting a small business grant can be challenging, but it can be worth it in the long run. There are numerous grants available to help small businesses, many of which can be found through industry associations and organizations that also offer loans.

A small business credit card is a type of financing that can be used for nearly any business need. It comes with a variety of interest rates and terms so comparison shopping is a must.

Like with most credit cards, the payment period typically spans 30 days. However, it can vary. You may pay interest on the difference or see an increase in interest owed over time.

Pro tip: Consider long payment terms, as these can help you maintain a healthy cash flow.

Venture capital is a type of private equity that is typically used to finance early-stage companies and startups. It comes from well-off investors and usually involves a variety of financial institutions.

This funding is used to help the company reach a wider market. Unlike startup financing options, a VC requires a company's equity in exchange for the money it gives.

If you're comfortable with having to share some of your earnings with someone else, a VC firm may be able to provide funding in a time of need. Before approaching a VC firm, make sure that you have a clear business plan.

How to create a financing strategy for startups

If you're a new business owner or still in the planning stages of starting a new venture, then you should get startup financing as soon as possible. But the financing journey doesn’t end once the cash is committed. Founders and owners must make sure that they understand the budget and revenue milestones attached to each round of financing they receive.

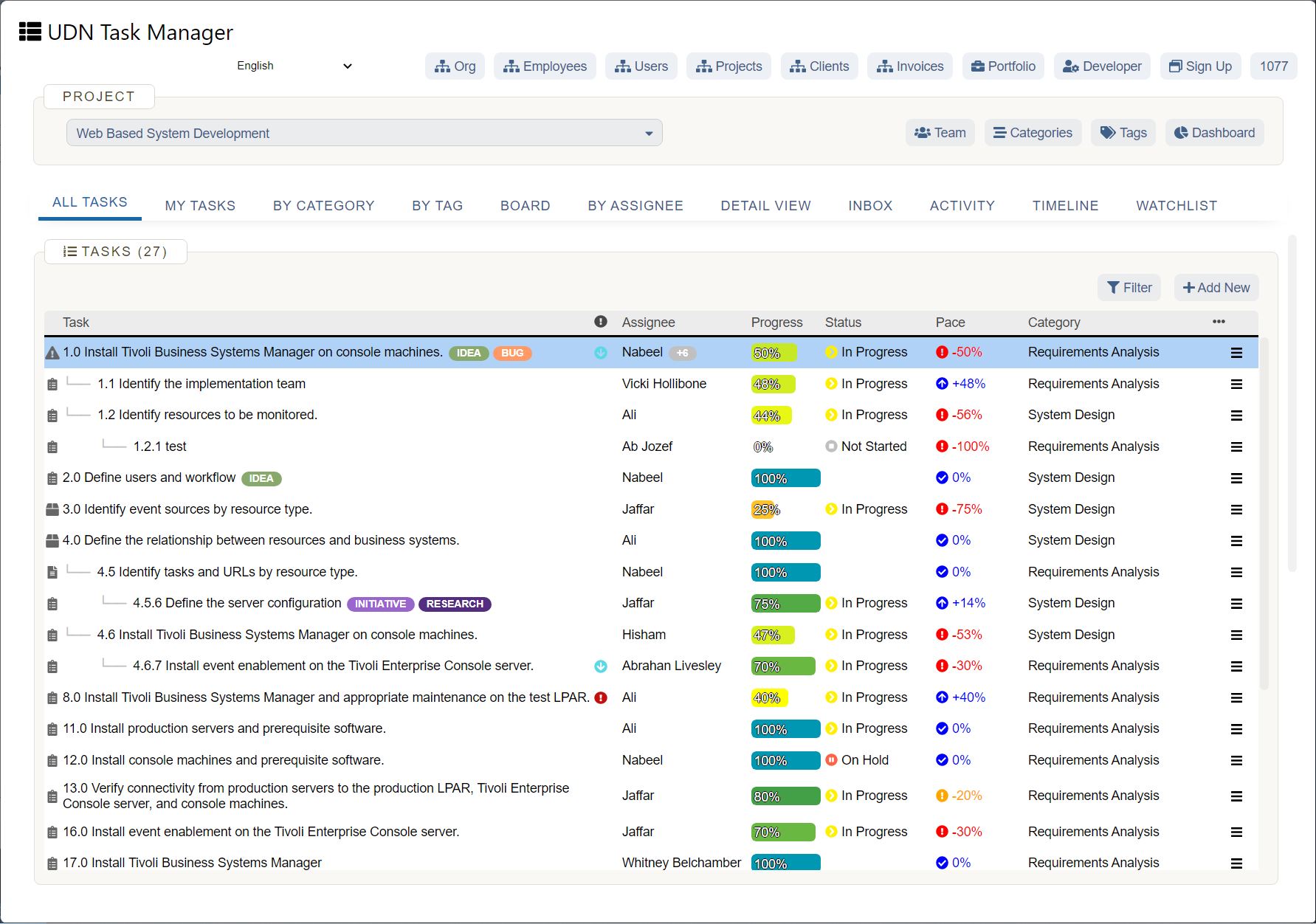

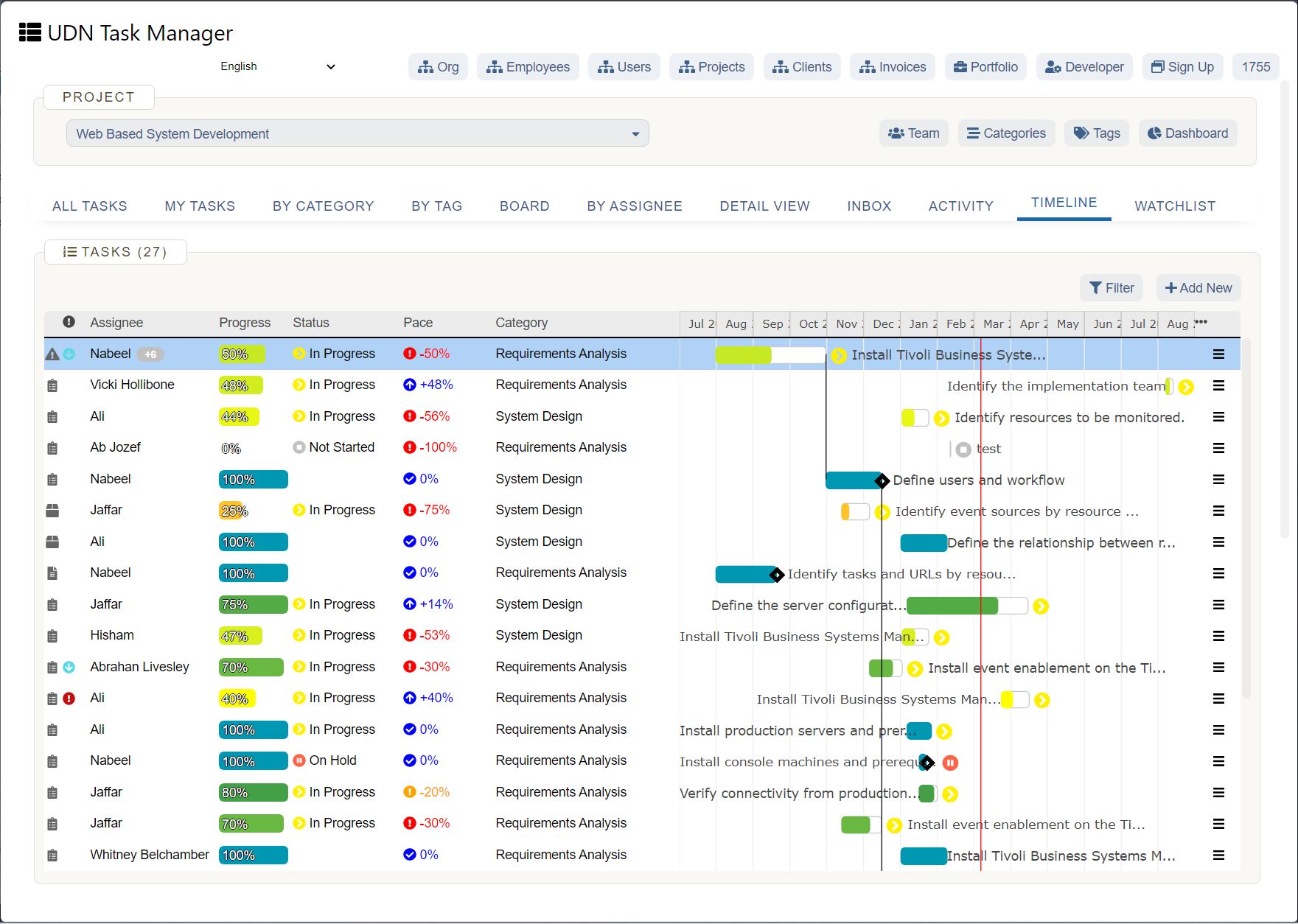

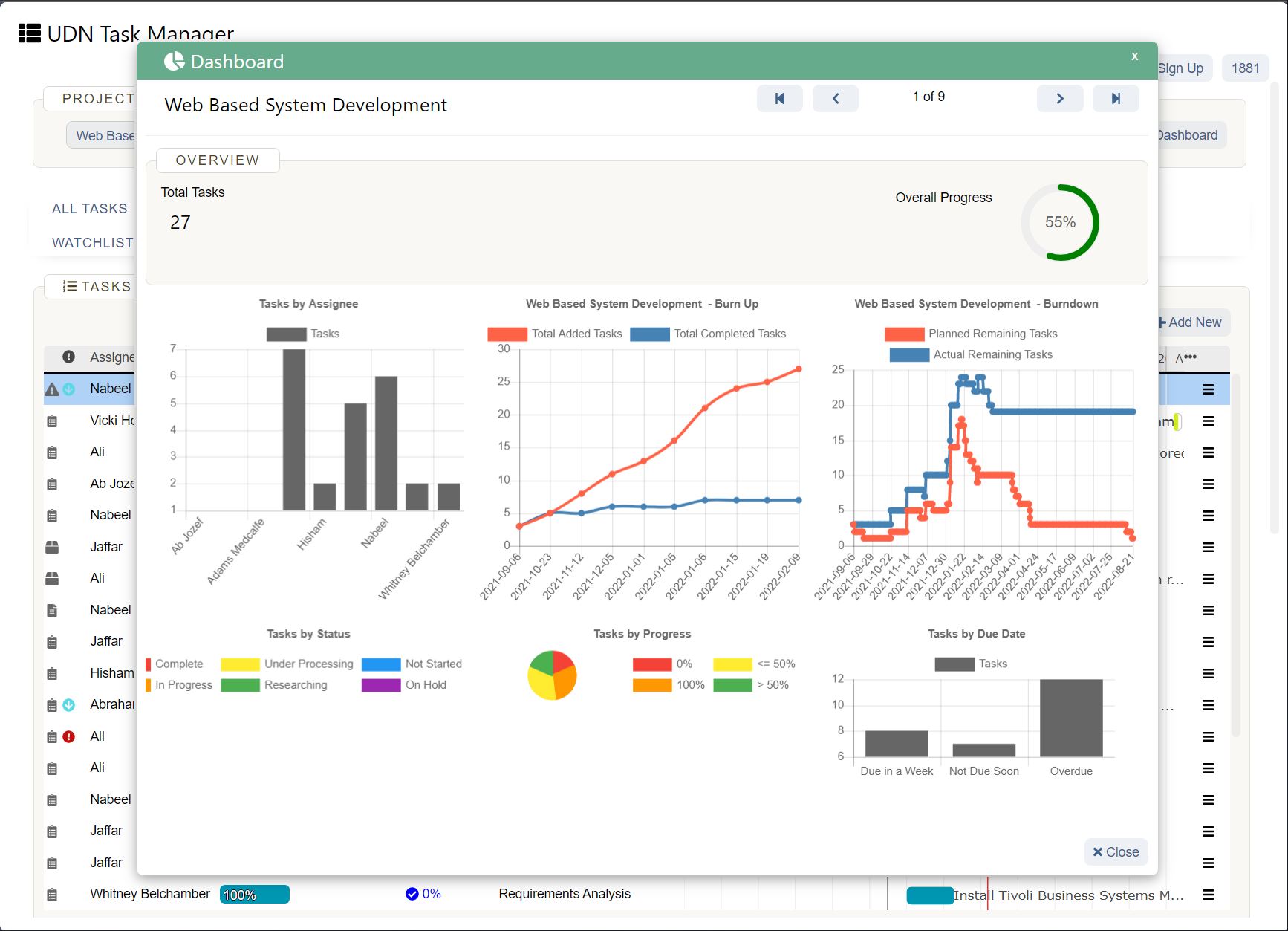

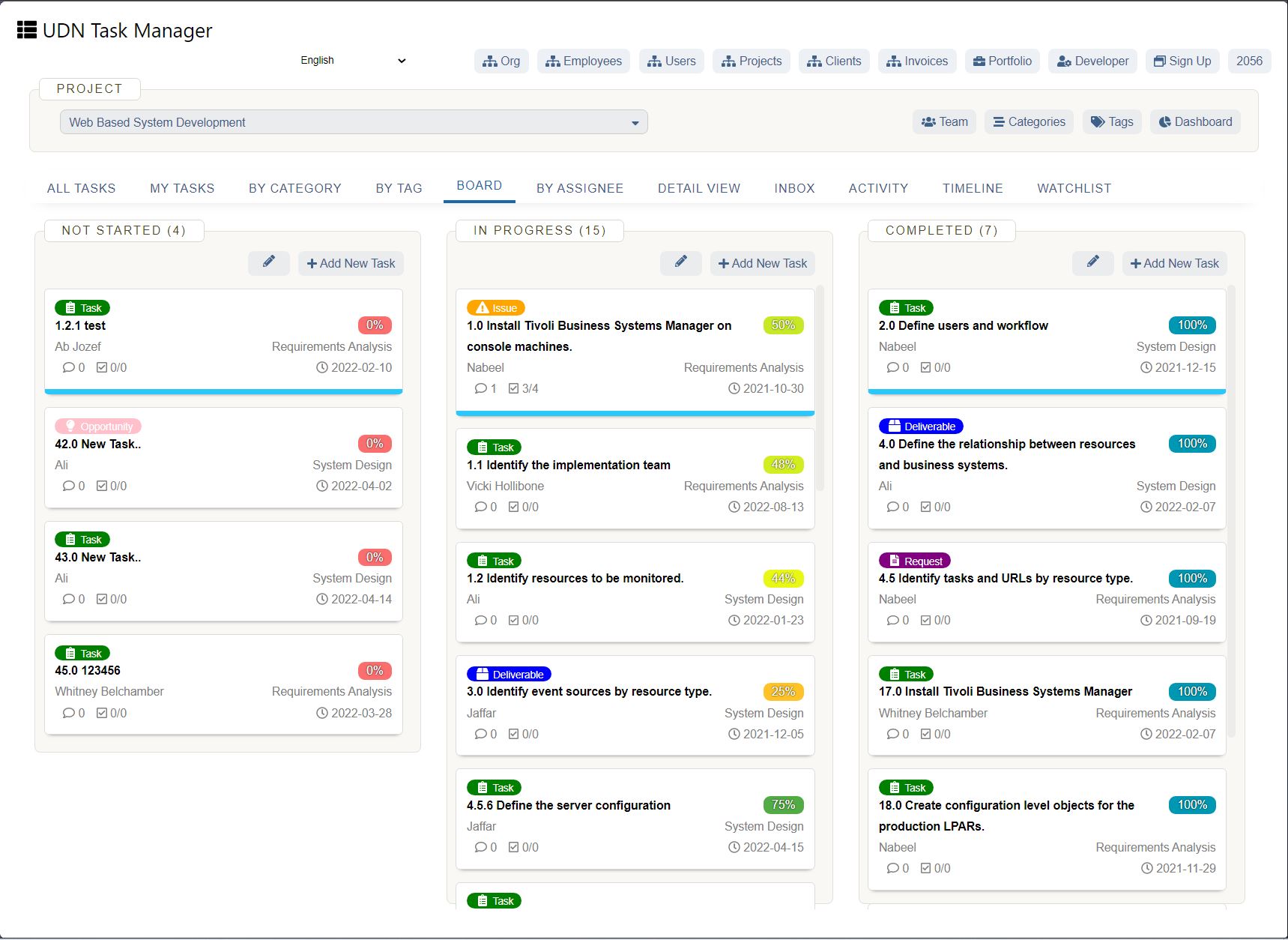

They should also create a step-by-step plan for achieving each of them in the right time frame. This requires a strong project management team and solution in order to achieve OKRs that both your team and your funding partner expect you to hit.

Tools you can use to surpass those expectations include:

How to responsibly manage money as a self-funded startup

There are many different opinions on what is considered responsible in the world of financing for startups. Some advise slow but steady fundraising with strategic alignments in order to grow over time and mitigate risk. Others believe it’s irresponsible to completely eliminate risk in the first place, as big risks can lead to big payouts.

Regardless of which side you’re leaning towards, you can use these tips for self-funded startups to meet and exceed expectations:

Set up your startup for success

Rock-solid forecasting, project plans, and templatized operations make winning funding from any source that much easier. Those in charge of decision-making at various financing outfits prioritize brands who show a professional level of risk management and organization, which a product like UDN Task Manager helps teams accomplish.

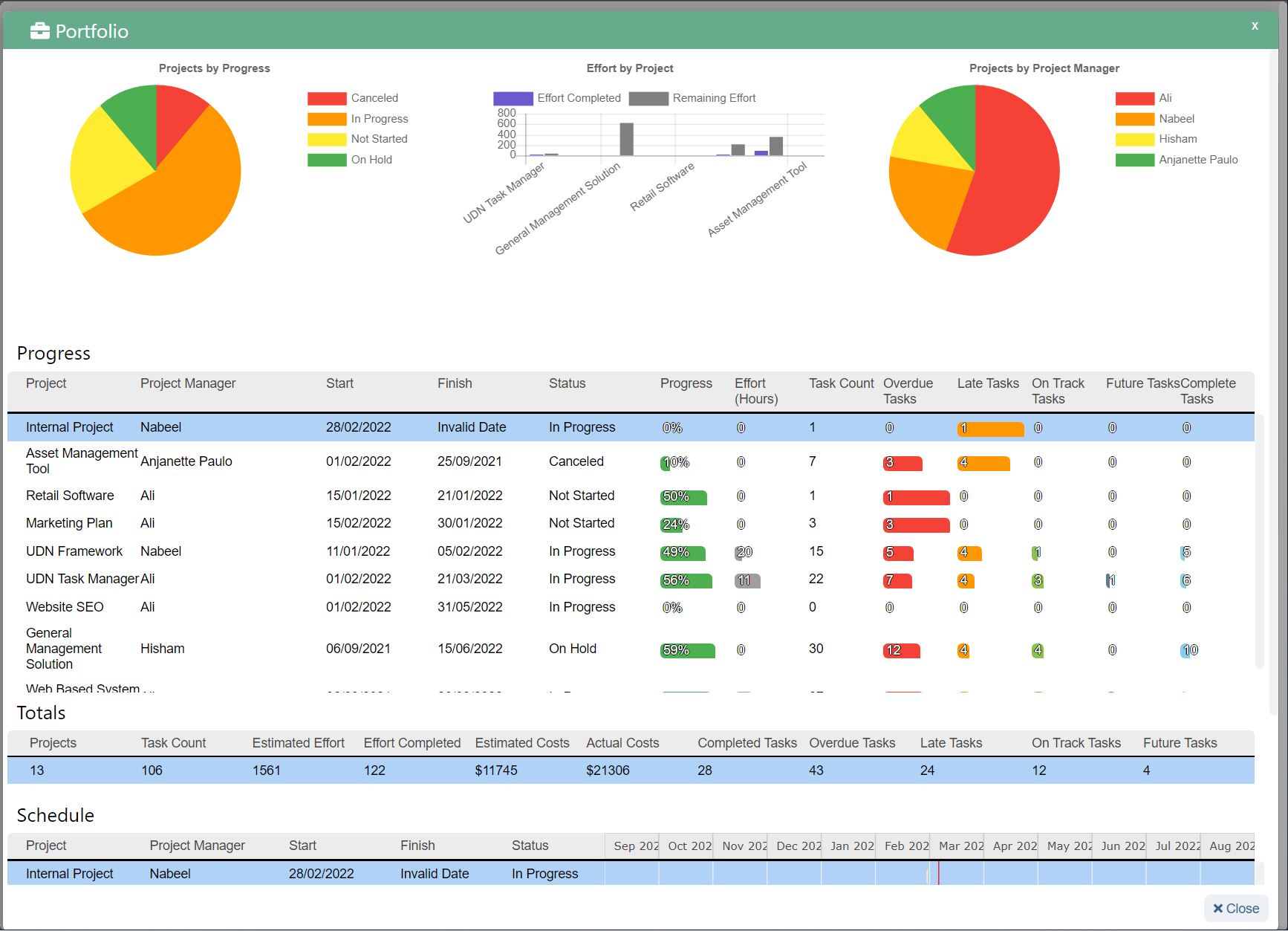

Whether you’re pitching your idea to an angel investor or need a well-laid-out plan for loan officers, UDN Task Manager can help you illustrate your ideas into an actionable business plan worth betting on.

Start with a two-week free trial of UDN Task Manager 's software today.