How to use a feasibility study in project management

It can be exciting to run a large, complex project that has a huge potential impact on your organization. On the one hand, you’re driving real change. On the other, failure is intimidating.

That’s where a feasibility study comes in. If you’ve never used a feasibility study for project management before, this article will walk you through everything you need to know to get started.

What is a feasibility study?

A feasibility study—sometimes called a feasibility analysis or feasibility report—is a way to evaluate whether or not a project plan could be successful. A feasibility study evaluates the practicality of your project plan in order to judge whether or not you’re able to move forward with the project.

It does so by answering two questions:

Does our team have the required tools or resources to complete this project?

Will there be a high enough return on investment to make the project worth pursuing?

Feasibility studies are important for projects that represent significant investments for your business. Projects that also have a large potential impact on your presence in the market may also require a feasibility study.

As the project manager , you may not be directly responsible for driving the feasibility study, but it’s important to know what these studies are. By understanding the different elements that go into a feasibility study, you can better support the team driving the feasibility study and ensure the best outcome for your project.

When to conduct a feasibility study

A feasibility study should be conducted after the project has been pitched but before any work has actually started. The study is part of the project planning process. In fact, it’s often done in conjunction with a SWOT analysis or project risk assessment , depending on the specific project.

Feasibility studies help:

Confirm market opportunities before committing to a project

Narrow your business alternatives

Create documentation about the benefits and detriments of your proposed initiative

Provide more information before making a go/no go decision

You likely don’t need a feasibility study if:

You already know the project is feasible

You’ve run a similar project in the past

Your competitors are succeeding with a similar initiative in market

The project is small, straightforward, and has minimal long-term business impact

Your team ran a similar feasibility study within the past three years

One thing to keep in mind is that a feasibility study is not a project pitch. During a project pitch, you’re evaluating whether or not the project is a good idea for your company, and whether the goals of the project are in line with your overall strategic plan. Typically, once you’ve established that the project is a good idea, you’d then run a feasibility study to confirm the project is possible with the tools and resources you have at your disposal.

Feasibility study vs. project charter

A project charter is a relatively informal document to pitch your project to stakeholders. Think of the charter like an elevator pitch of your project objectives, scope, and responsibilities. Typically, your project sponsor or executive stakeholders reviews the charter before ratifying the project.

A feasibility study should be implemented after the project charter has been ratified. This isn’t a document to pitch whether or not the project is in line with your team’s goals—rather, it’s a way to ensure the project is something you and your team can accomplish.

Feasibility study vs. business case

A business case is a more formalized version of the project charter. While you’d typically create a project charter for small or straightforward initiatives, you should create a business case if you are pitching a large, complex initiative that will make a major impact on the business. This longer, more formal document will also include financial information, and typically involves more senior stakeholders.

After your business case is approved by relevant stakeholders, you’d then run a feasibility study to make sure the work is doable. If you find it isn’t, you might return to your executive stakeholders and request more resources, tools, or time in order to ensure your business case is feasible.

Feasibility study vs. business plan

A business plan is a formal document of your organization’s goals. You typically write a business plan when founding your company, or when your business is going through a significant shift. Your business plan informs a lot of other business decisions, including your three to five year strategic plan .

As you implement your business and strategic plan, you’ll invest in individual projects. A feasibility study is a way to evaluate the practicality of any given individual project or initiative.

The 4 elements of a feasibility analysis

There are four main elements that go into a feasibility study: technical feasibility, financial feasibility, market feasibility (or market fit), and operational feasibility. You may also see these referred to as the four types of feasibility studies, though most feasibility studies actually include a review of all four elements.

Technical feasibility

A technical feasibility study reviews the technical resources available for your project. This study determines if you have the right equipment, enough equipment, and the right technical knowledge to complete your project objectives . For example, if your project plan proposes creating 50,000 products per month, but you can only produce 30,000 products per month in your factories, this project isn’t technically feasible.

Financial feasibility

Financial feasibility describes whether or not your project is fiscally viable. A financial feasibility report includes a cost/benefit analysis of the project. It also forecasts an expected return on investment (ROI), as well as outlines any financial risks. The goal at the end of the financial feasibility study is to understand the economic benefits the project will drive.

Market feasibility

The market feasibility study is an evaluation of how your team expects the project’s deliverables to perform in the market. This part of the report includes a market analysis, market competition breakdown, and sales projections.

Operational feasibility

An operational feasibility study evaluates whether or not your organization is able to complete this project. This includes staffing requirements, organizational structure, and any applicable legal requirements. At the end of the operational feasibility study, your team will have a sense of whether or not you have the resources, skills, and competencies to complete this work.

Feasibility study checklist

Most feasibility studies are structured in a similar way. These documents serve as an assessment of the practicality of a proposed business idea. Creating a clear feasibility study helps project stakeholders during the decision making process.

A feasibility study contains:

An executive summary describing the project’s overall viability

A description of the product or service being developed during this project

Any technical considerations , including technology, equipment, or staffing

The market survey , including a study of the current market and the marketing strategy

The operational feasibility study , evaluating whether or not your team’s current organizational structure can support this initiative

The project timeline

Financial projections based on your financial feasibility report

6 steps for conducting a feasibility study

You likely won’t be conducting the feasibility study yourself, but you will probably be called on to provide insight and information. To conduct a feasibility study, hire a trained consultant or, if you have an in-house project management office (PMO) , ask if they take on this type of work. In general, here are the steps they’ll take to complete this work:

1. Run a preliminary analysis

Creating a feasibility study is a time-intensive process. Before diving into the feasibility study, it’s important to evaluate the project for any obvious and insurmountable roadblocks. For example, if the project requires significantly more budget than your organization has available, you likely won’t be able to complete it. Similarly, if the project deliverables need to be live and in market by a certain date, but they won’t be available for several months after the fact, the project likely isn’t feasible either. These types of large-scale obstacles make a feasibility study unnecessary, because it’s clear the project is not viable.

2. Evaluate financial feasibility

Think of the financial feasibility study as the projected income statement for the project. This part of the feasibility study clarifies the expected project income and outlines what your organization needs to invest—in terms of time and money—in order to hit the project objectives.

During the financial feasibility study, take into account whether or not the project will impact your business's cash flow. Depending on the complexity of the initiative, your internal PMO or external consultant may want to work with your financial team to run a cost-benefit analysis of the project.

3. Run a market assessment

The market assessment, or market feasibility study, is a chance to identify the demand in the market. This study offers a sense of expected revenue for the project, and any potential market risks you could run into.

The market assessment, more than any other part of the feasibility study, is a chance to evaluate whether or not there’s an opportunity in the market. During this study, it’s critical to evaluate your competitor’s positions and analyze demographics to get a sense of how the project will do.

4. Consider technical and operational feasibility

Even if the financials are looking good and the market is ready, this initiative may not be something your organization can support. To evaluate operational feasibility, consider any staffing or equipment requirements this project needs. What organizational resources—including time, money, and skills—are necessary in order for this project to succeed?

Depending on the project, it may also be necessary to consider the legal impact of the initiative. For example, if the project involves developing a new patent for your product, you will need to involve your legal team and incorporate that requirement into the project plan.

5. Review points of vulnerability for the project

At this stage, your internal PMO team or external consultant have looked at all four elements of your feasibility study—financials, market analysis, technical feasibility, and operational feasibility. Before running their recommendations by you and your stakeholders, they will review and analyze the data for any inconsistencies. This includes ensuring the income statement is in line with your market analysis. Similarly, now that they’ve run a technical feasibility study, are any liabilities too big of a red flag? (If so, create a contingency plan !)

Depending on the complexity of your project, there won’t always be a clear answer. A feasibility analysis doesn’t provide a black and white decision for a complex problem. Rather, it helps you come to the table with the right questions—and answers—so you can make the best decision for your project and for your team.

6. Propose a decision

The final step of the feasibility study is an executive summary touching on the main points and proposing a solution.

Depending on the complexity and scope of the project, your internal PMO or external consultant may share the feasibility study with stakeholders or present it to the group in order to field any questions live. Either way, with the study in hand, your team now has the information you need to make an informed decision.

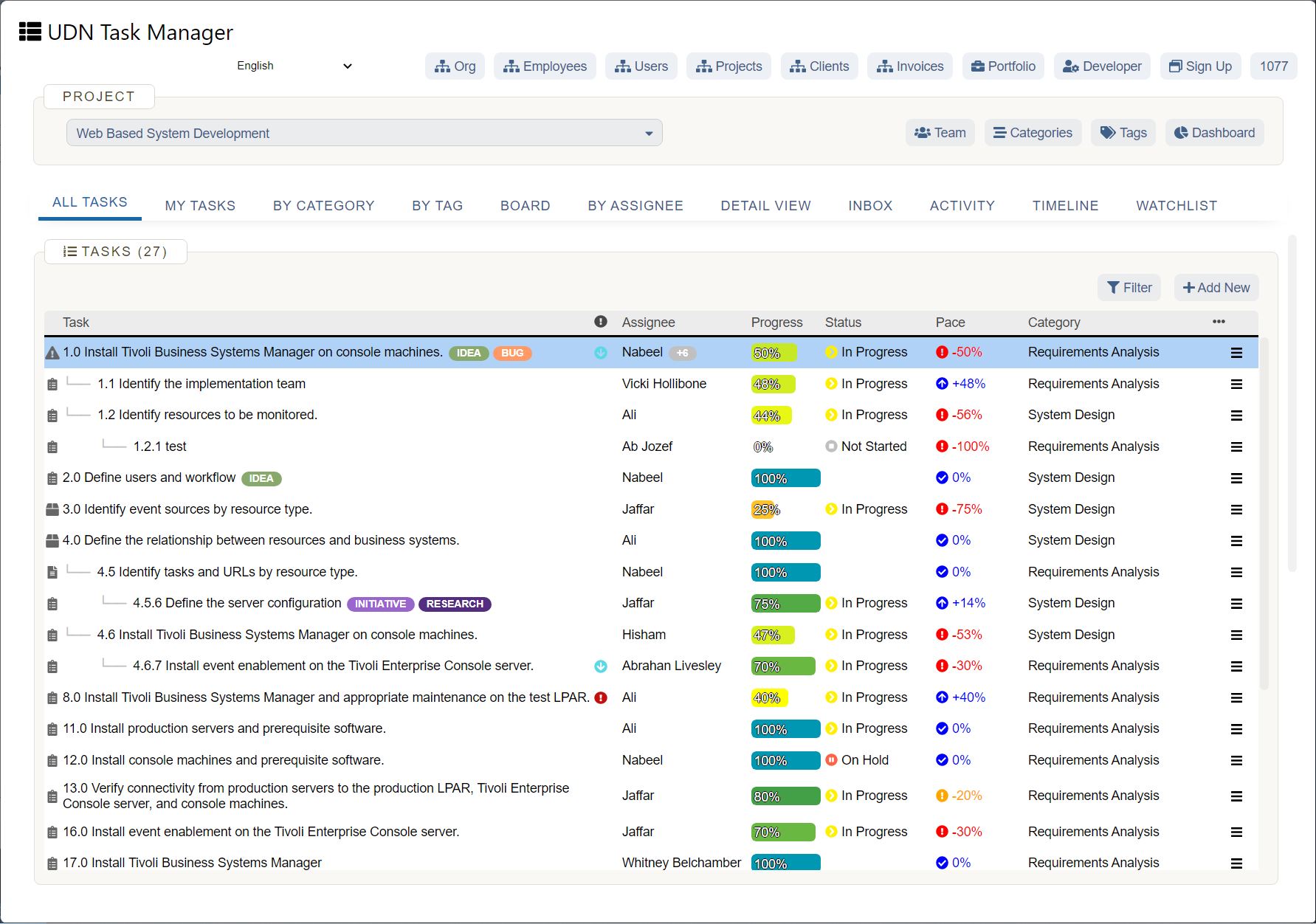

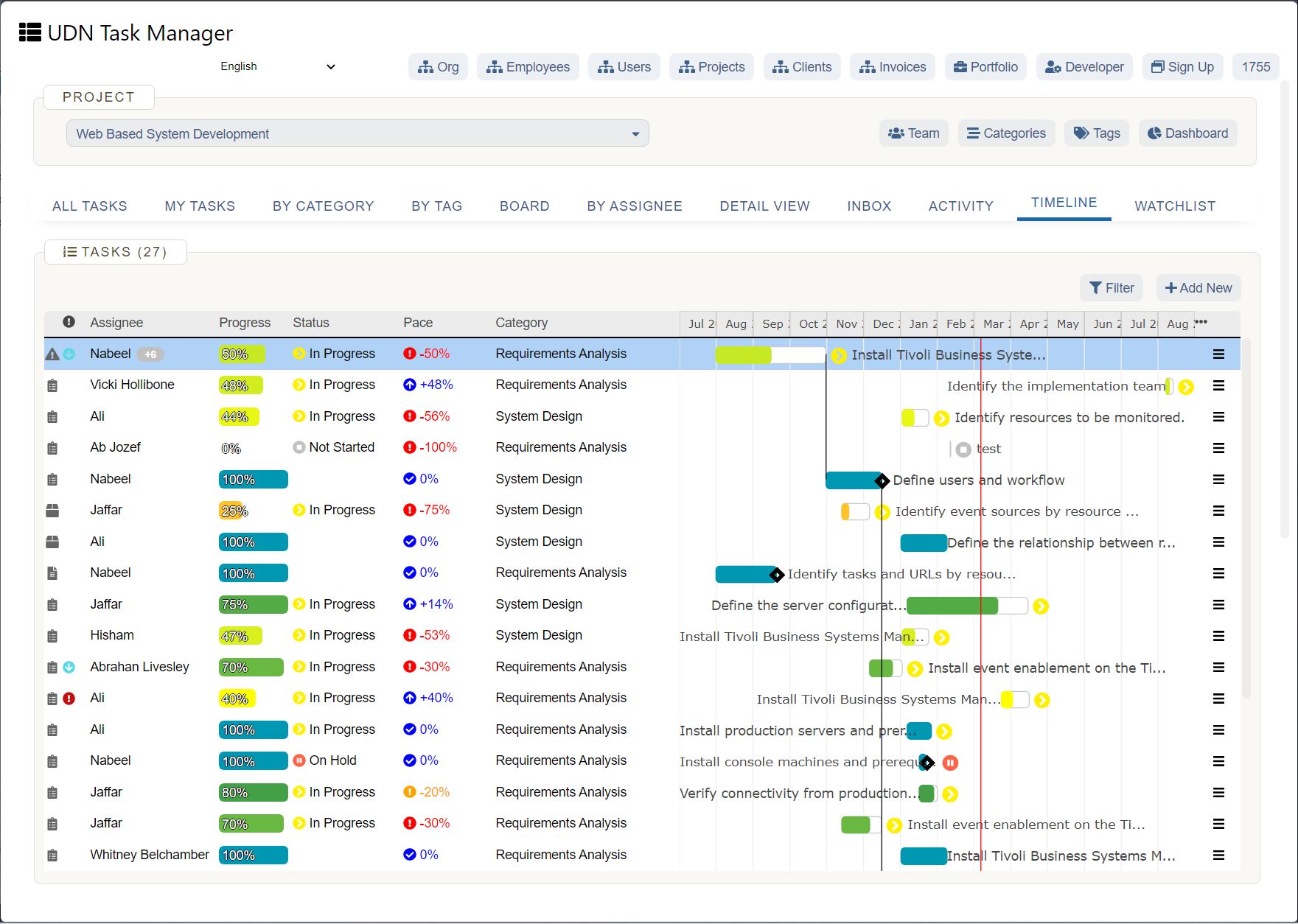

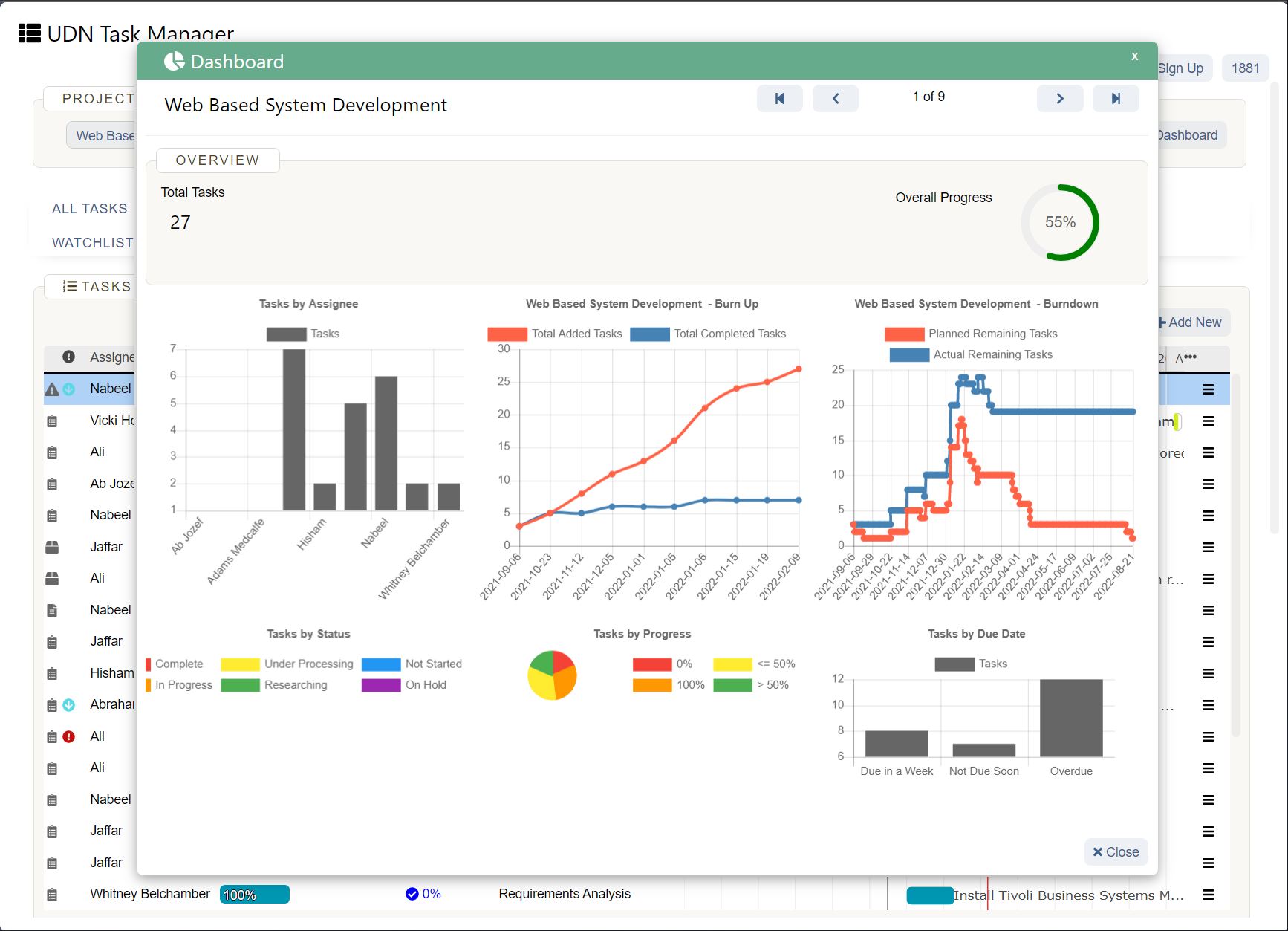

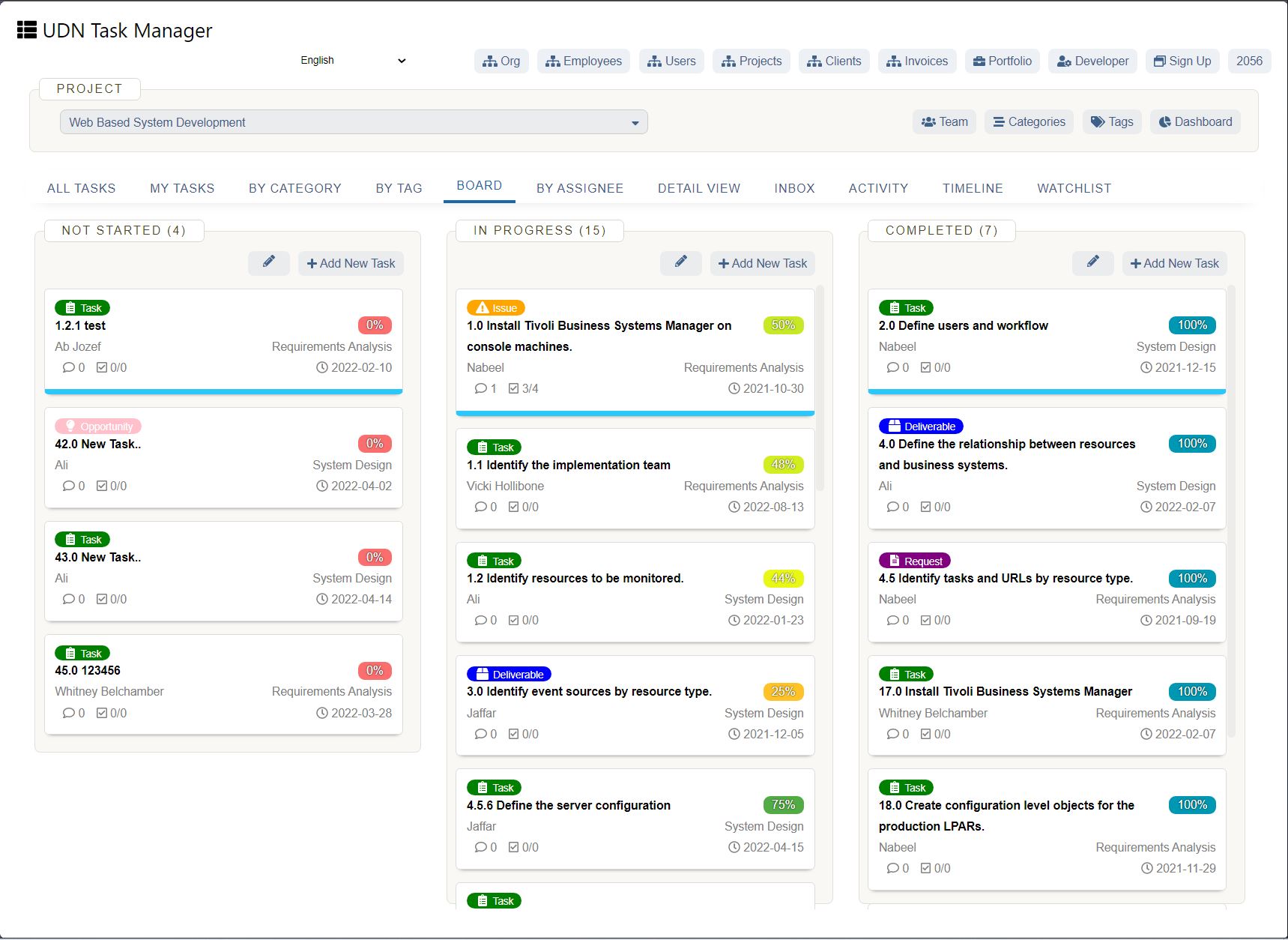

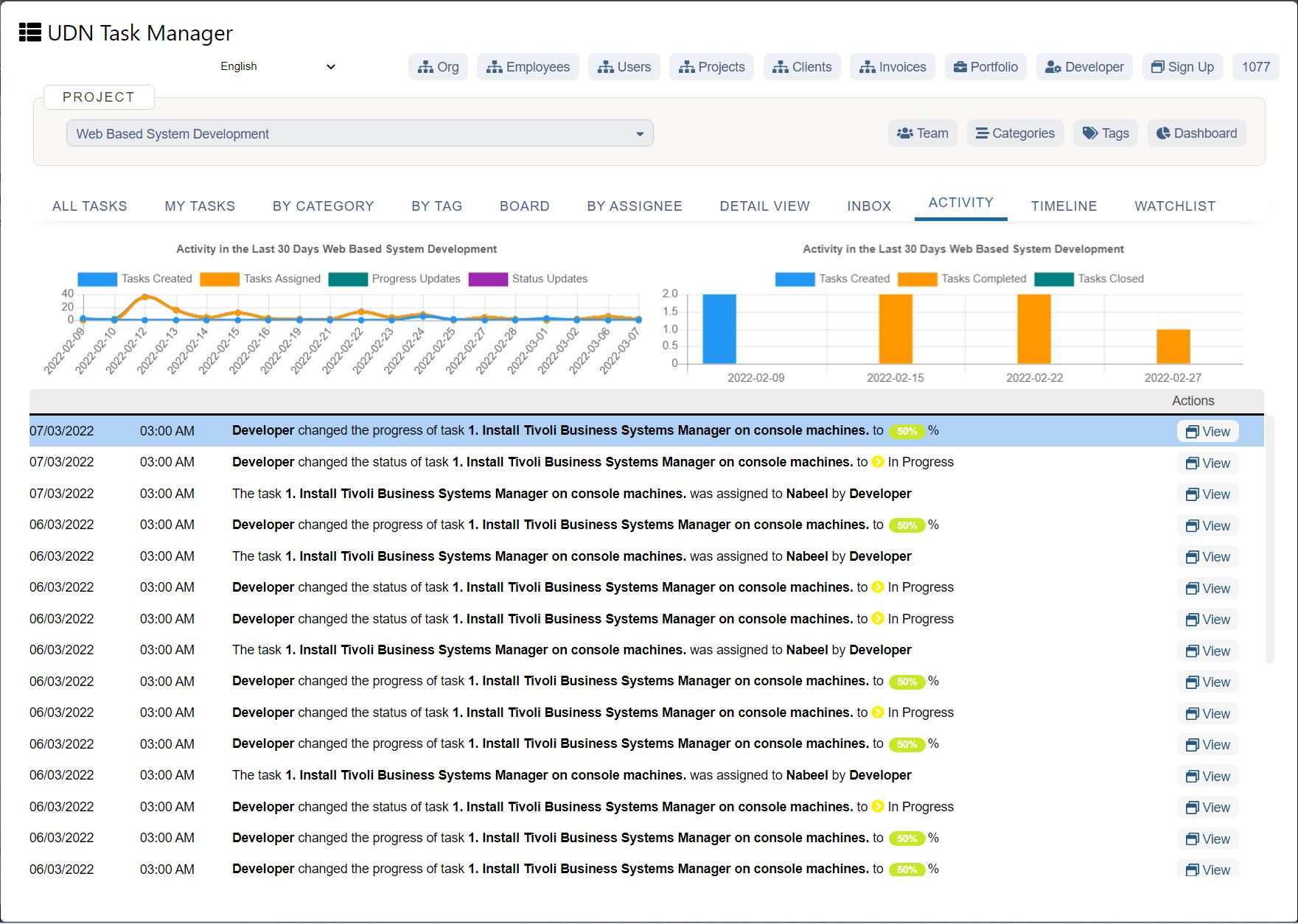

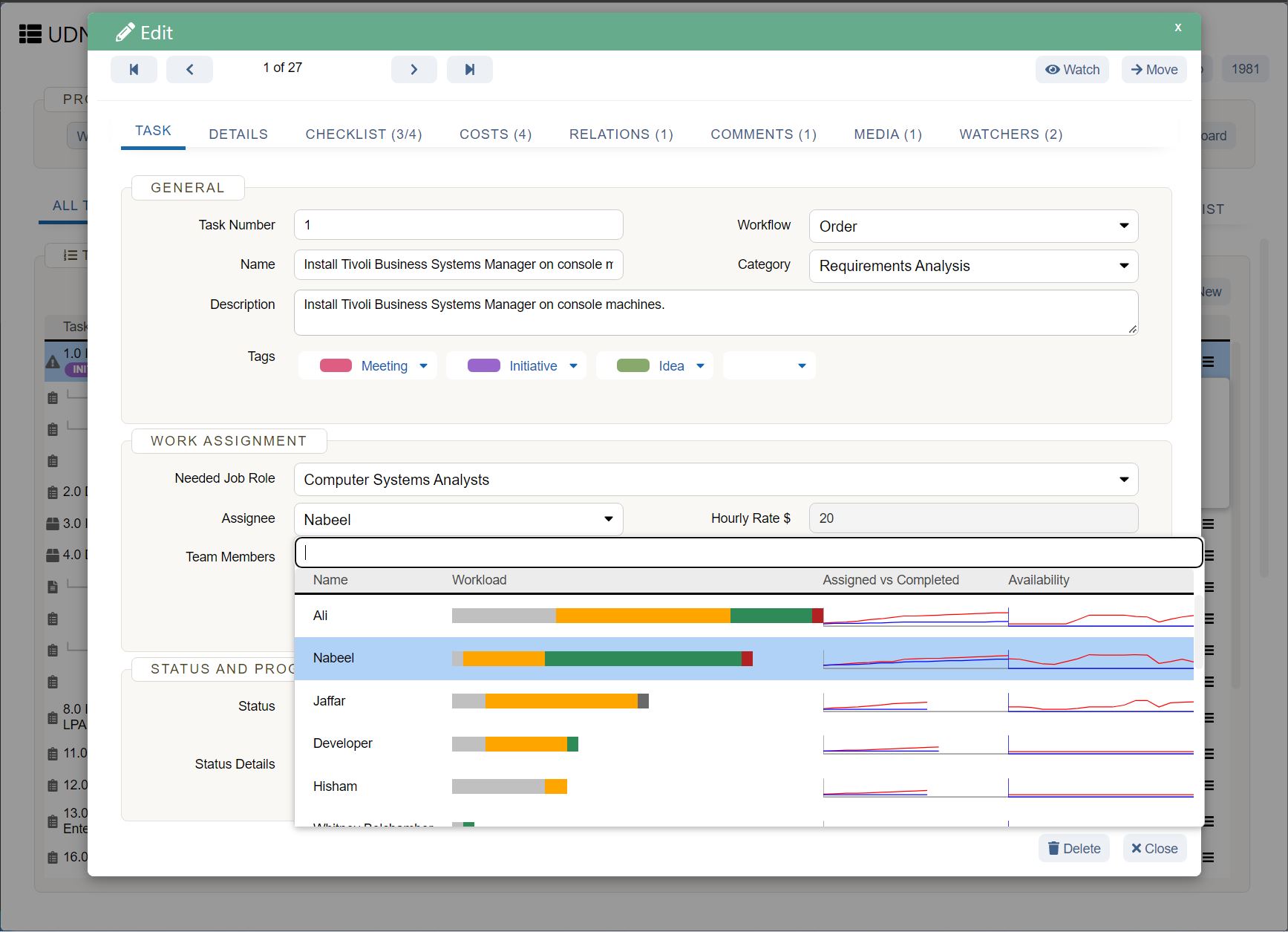

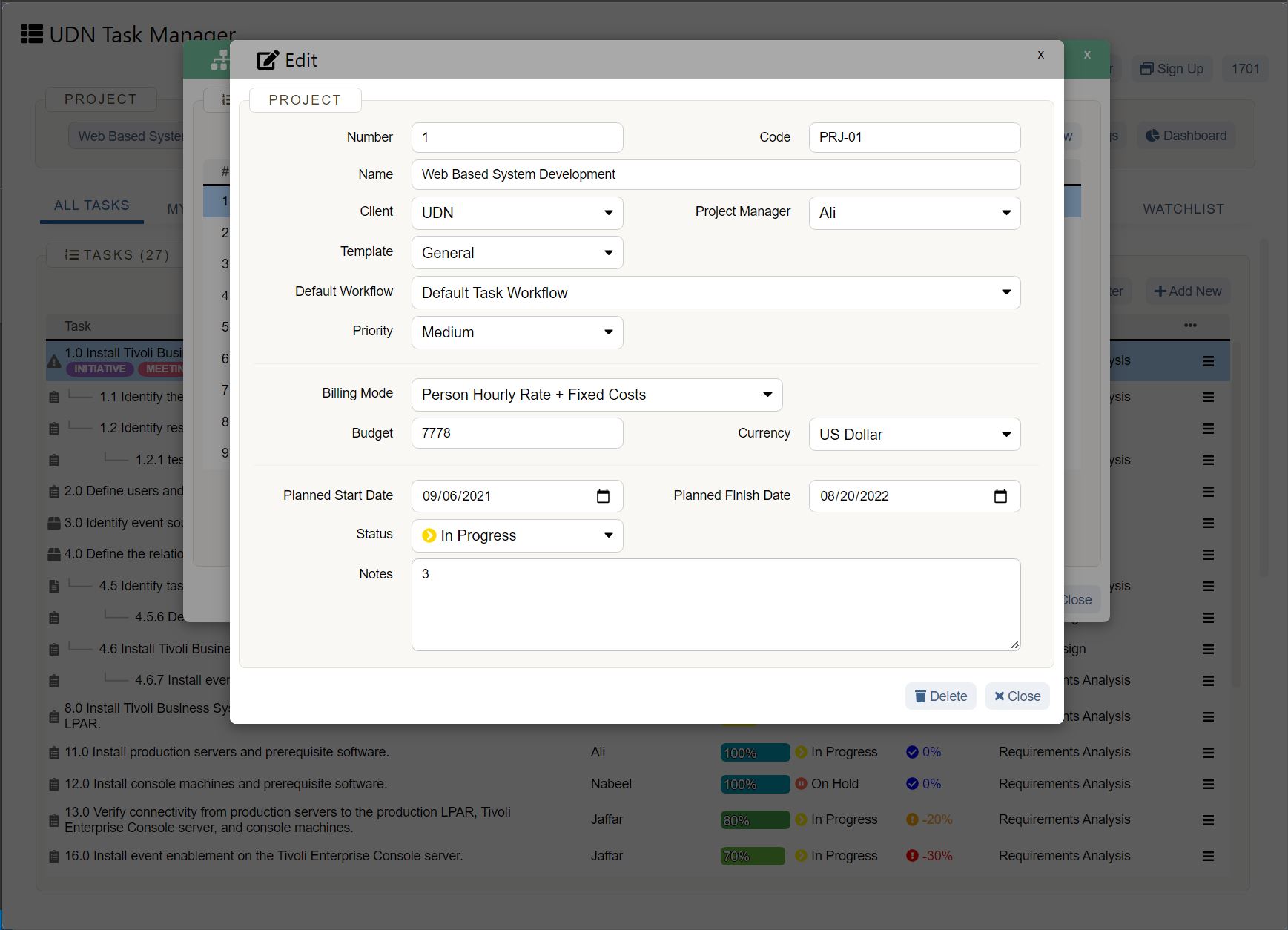

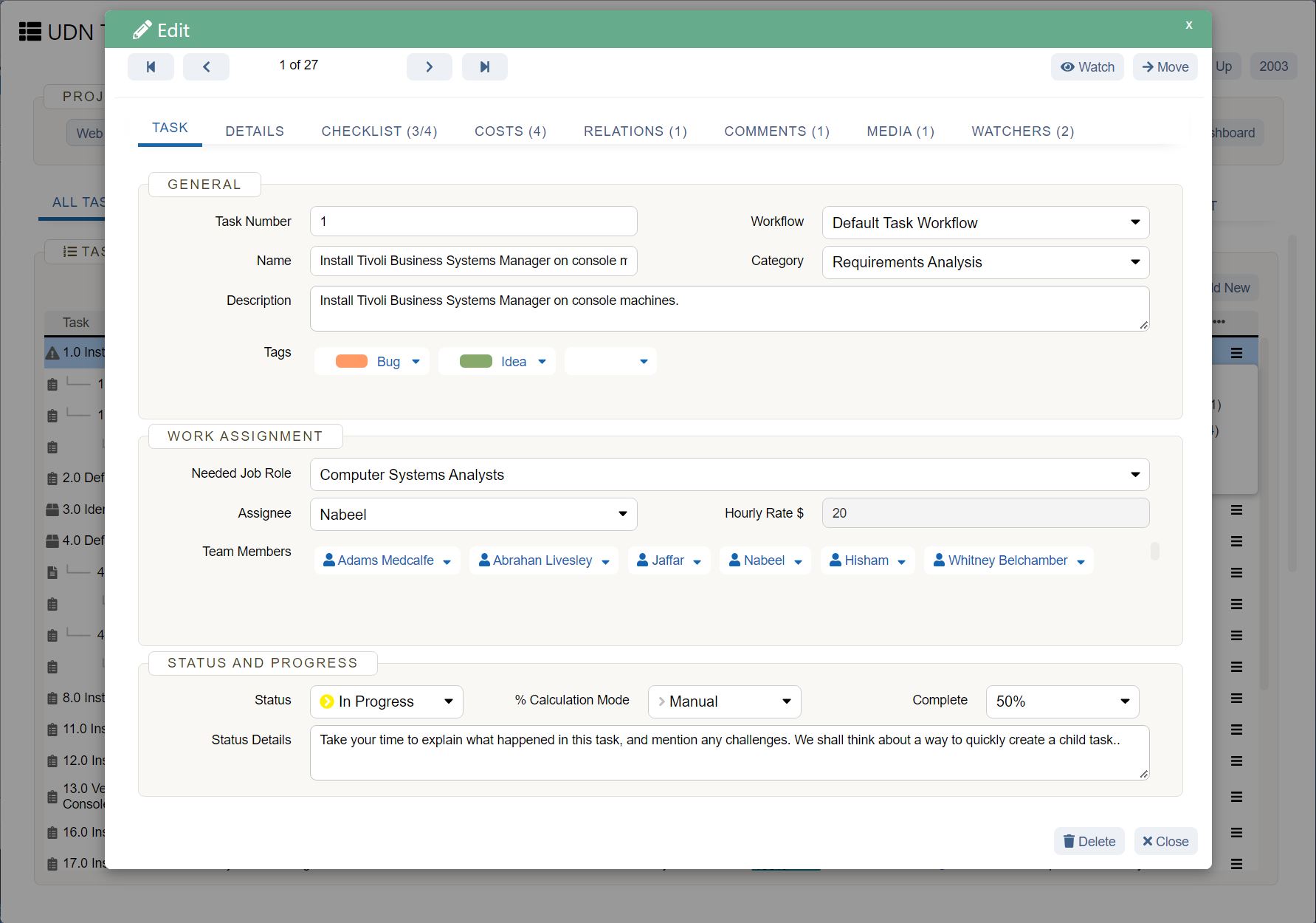

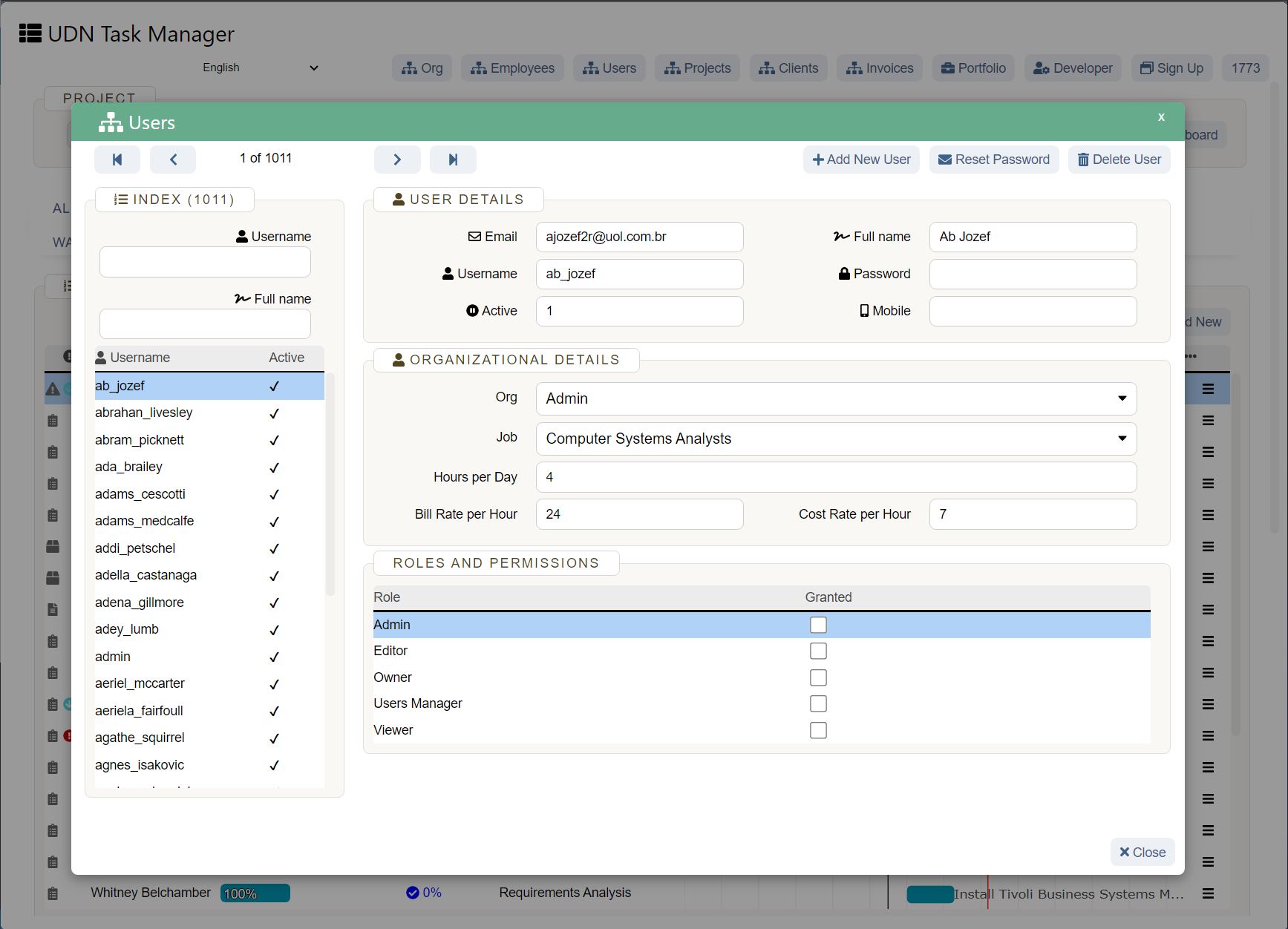

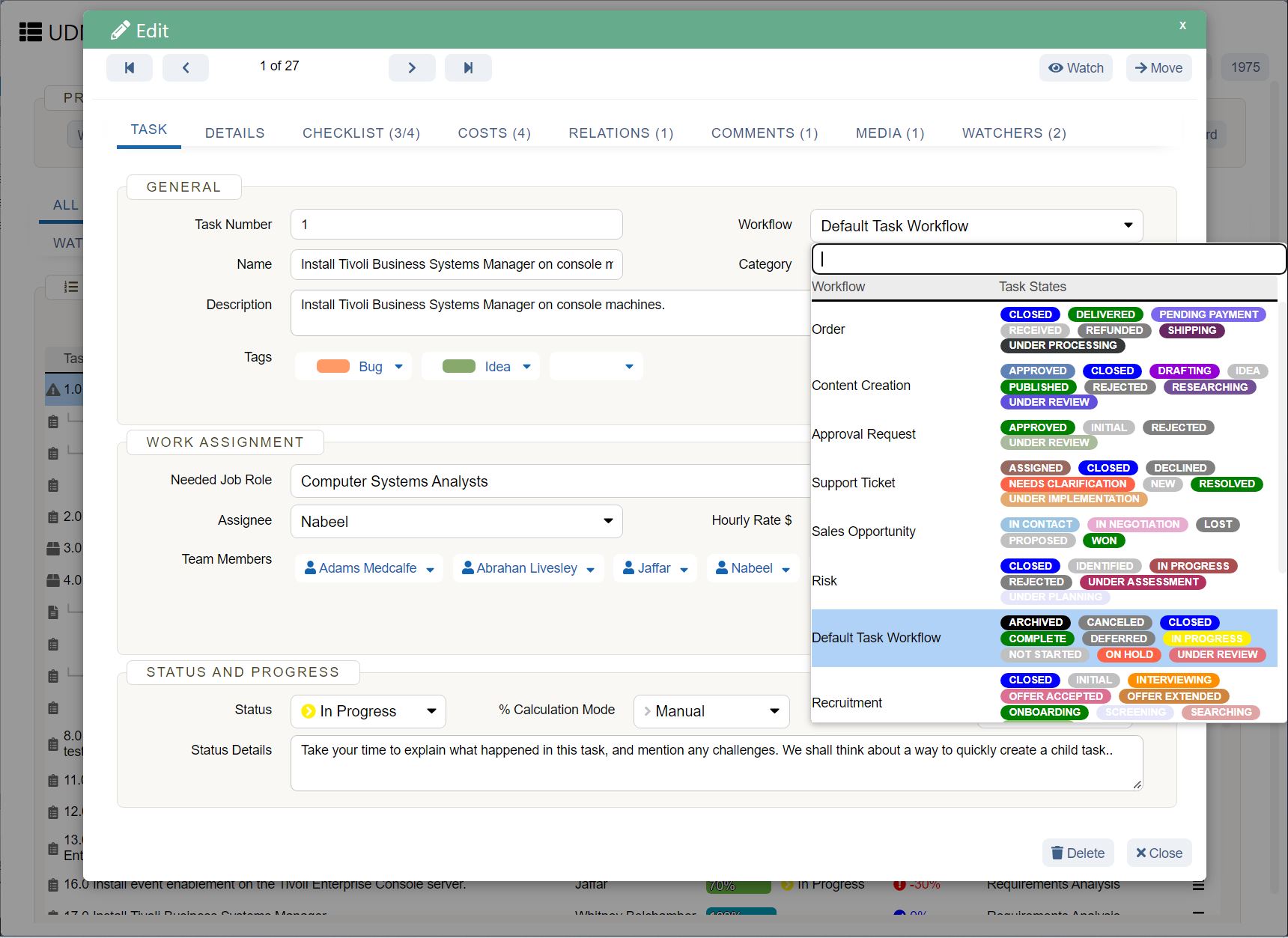

Achieve project success with UDN Task Manager

Done with your feasibility study? You’re ready to run a project! Set your project up for success by tracking your progress in a work management tool , like UDN Task Manager . From the small stuff to the big picture, UDN Task Manager organizes work so teams know what to do, why it matters, and how to get it done.