Mergers & Acquisitions: Complete Guide to M&A Project Management

Mergers and acquisitions (M&A) is a consolidation of companies and their assets through various types of financial agreements, including debt-to-equity, tender offers, purchase of assets, management acquisitions, mergers, or acquisitions.

It's a complex process that requires an incredible amount of planning , organization, communication, insight, and management. Deal teams must have proper management expertise, tools, and technology to advance the process.

This is where M&A project management comes in. M&A planning is a component of your organization’s strategic planning. Whether you're the acquiring or selling company, it's essential to stay on top of what happens in your industry. M&A managers should know how mergers or acquisitions within their industry may impact their organization's positioning.

What is M&A project management?

M&A project management is the process of applying project management best practices to pre- and post-merger activities. When two companies consolidate or one firm acquires another, there are a complex series of steps an M&A project manager must execute to close the deal and integrate both companies successfully. When using M&A project management, it's important to be confident in your ability of how to manage a project from start to finish , as M&A projects are often lengthy and involve conversations at various stages along the way. M&A project management uses project management methods to achieve the goals of the M&A deal, which generally includes creating higher value for shareholders and maintaining business continuity .

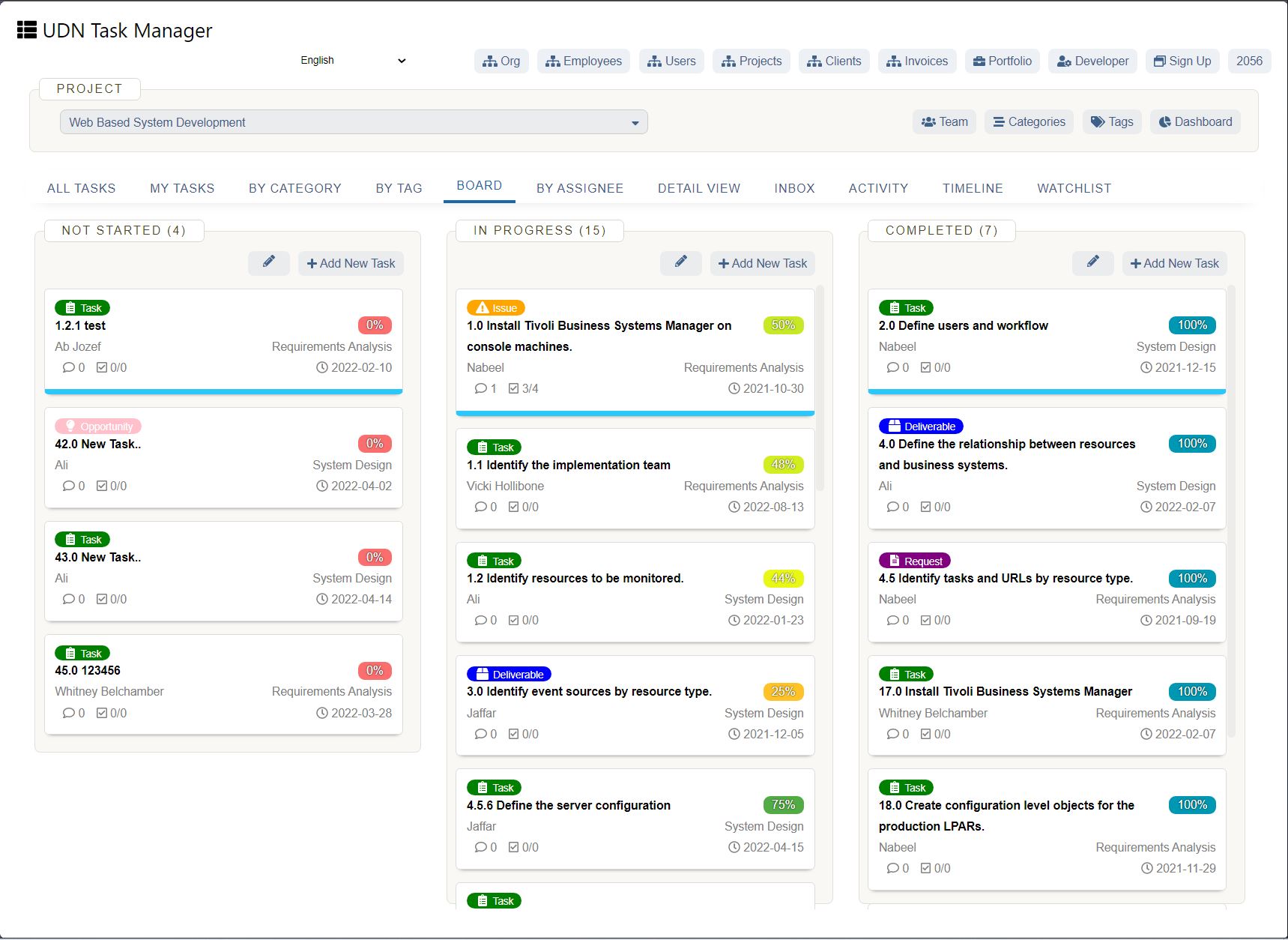

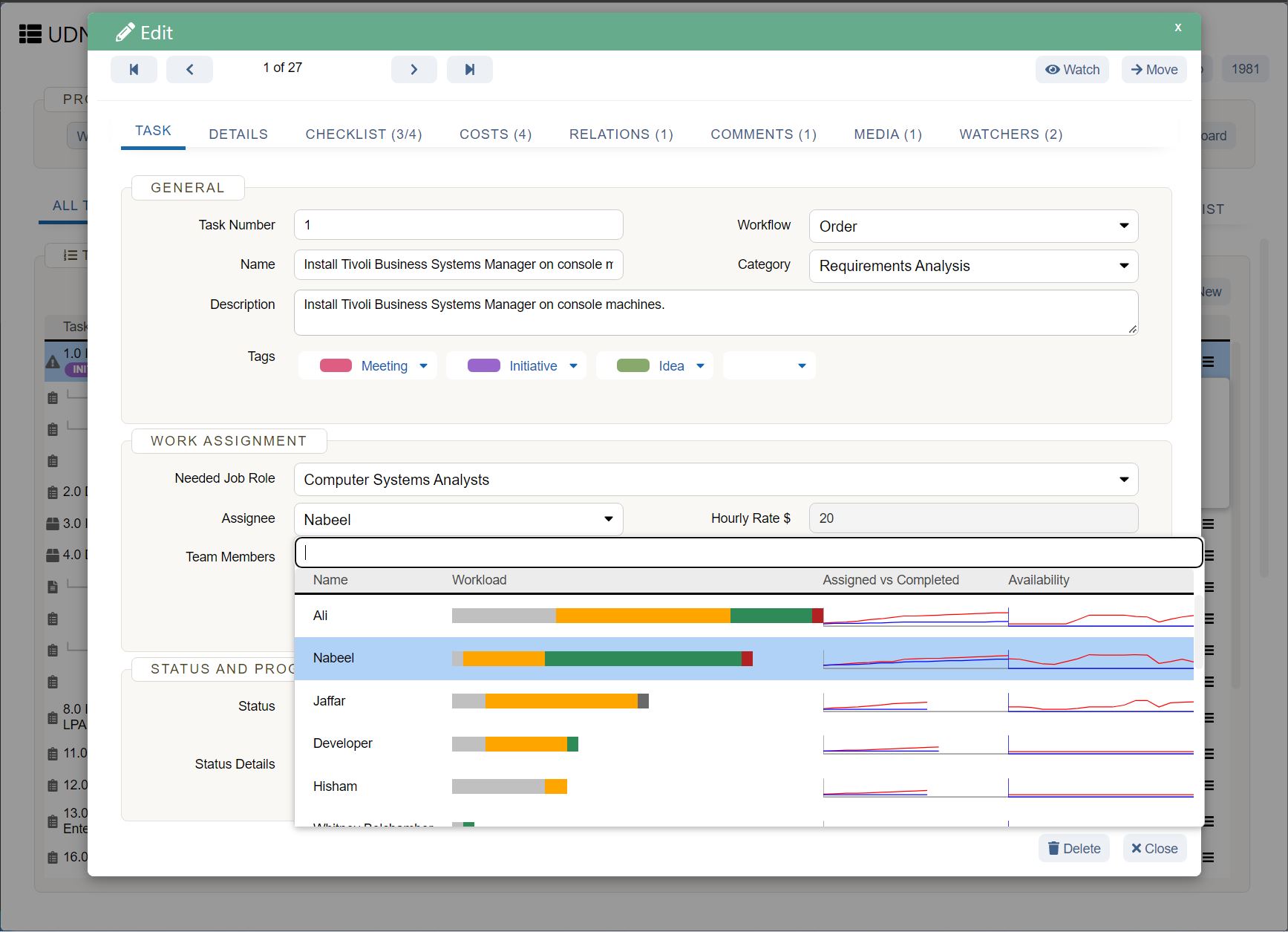

M&A project management handles responsibilities, including designating key roles and tasks, supervising workflows, and establishing standards, timelines, and targets in the post-merger organization.

What does an M&A project manager do?

Industry-specific knowledge for an M&A project manager is helpful but not required. It's more important that M&A managers have experience closing M&A deals and implementing integration plans post-merger, and have a clear idea of each individual project definition when beginning a new M&A deal.

The M&A project manager evaluates both companies’ opportunities for mergers, acquisitions, and divestitures . They oversee pre- and post-merger financial planning, scoping, closing, and integration and coordinate research and analysis activities to assess risk and impact. M&A project managers must be adept at collaborating with stakeholders, managing staff, and developing financial models and projections to estimate cash flow and profitability potential.

A good M&A project manager should have the following skills:

Why is M&A project management important?

M&A project management is critical because it impacts the post-merger relationship between both companies. M&A is itself a big project with extensive interdependencies. Good M&A project management helps to keep your teams on track, aligned, and eventually successful. Other benefits of M&A project management include:

M&A project management provides guidelines, structure, and documentation to close M&A transactions, integrate operations, and make adequate, realistic staffing and resource allocation decisions in the post-merger organization.

Key processes in pre-merger M&A project management

M&A project management is crucial during the pre-merger phase, as it lays the foundation for the rest of the M&A implementation. This includes developing your strategy, searching for targets, conducting negotiations, and making efforts to close a deal.

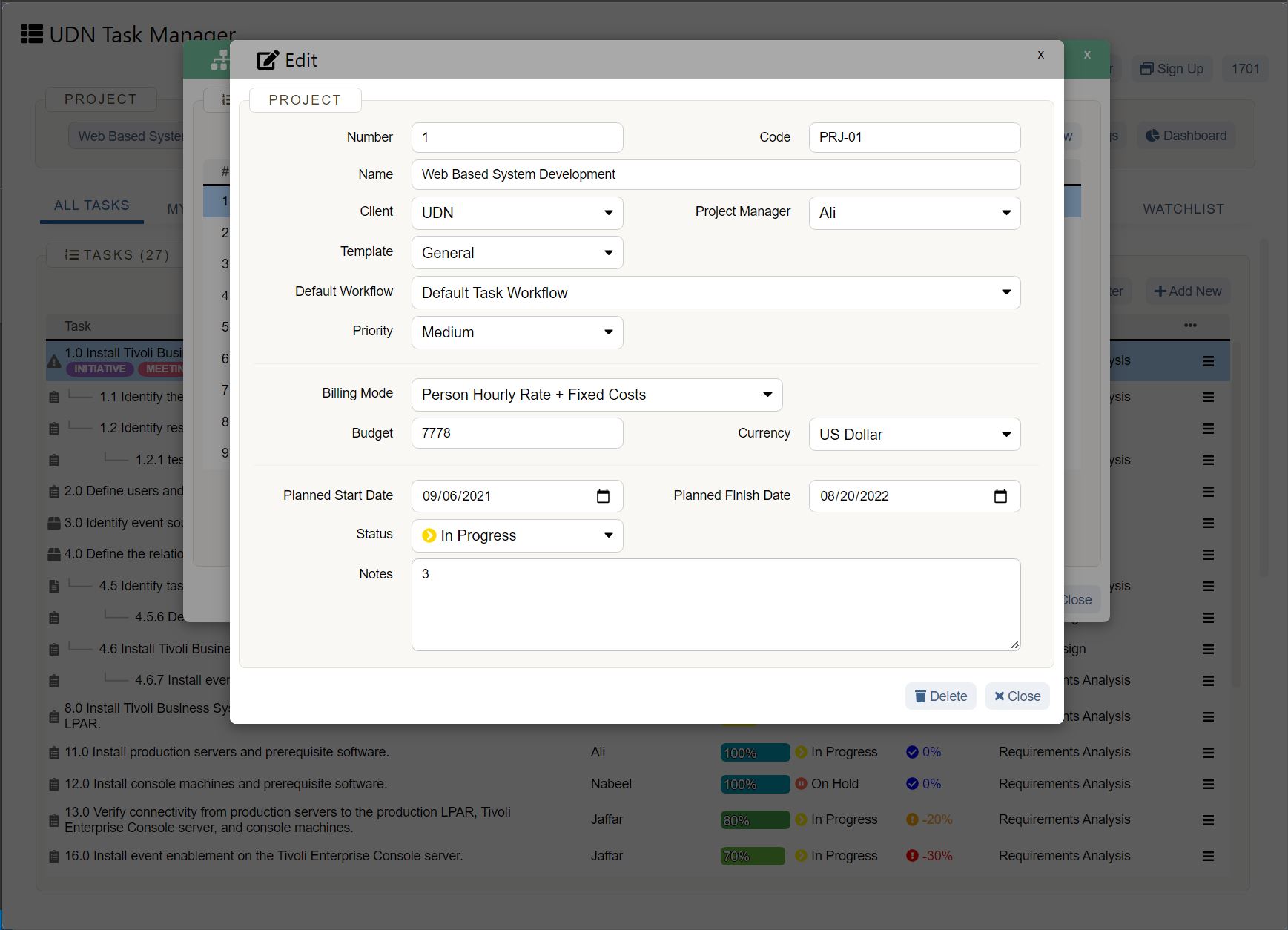

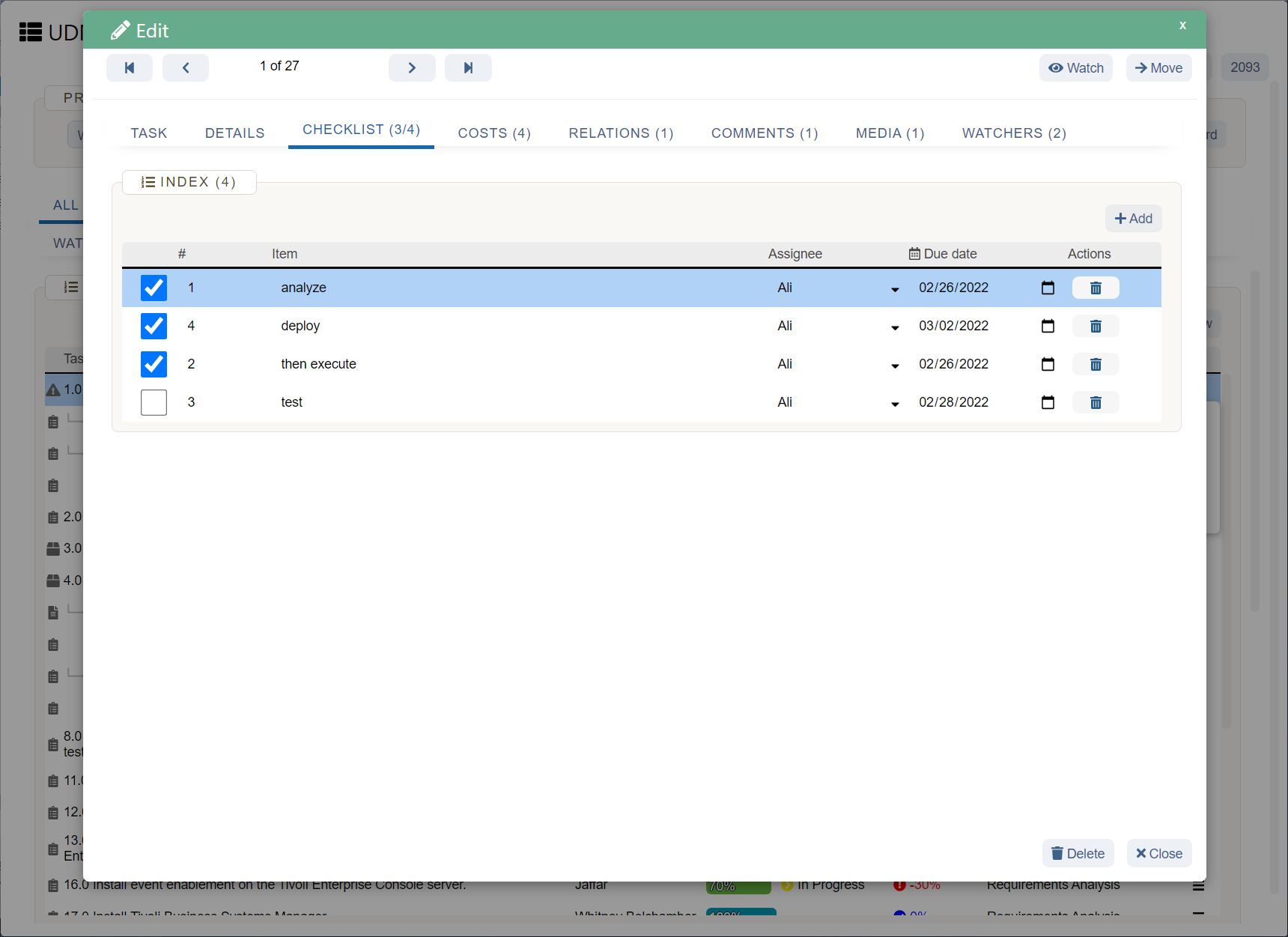

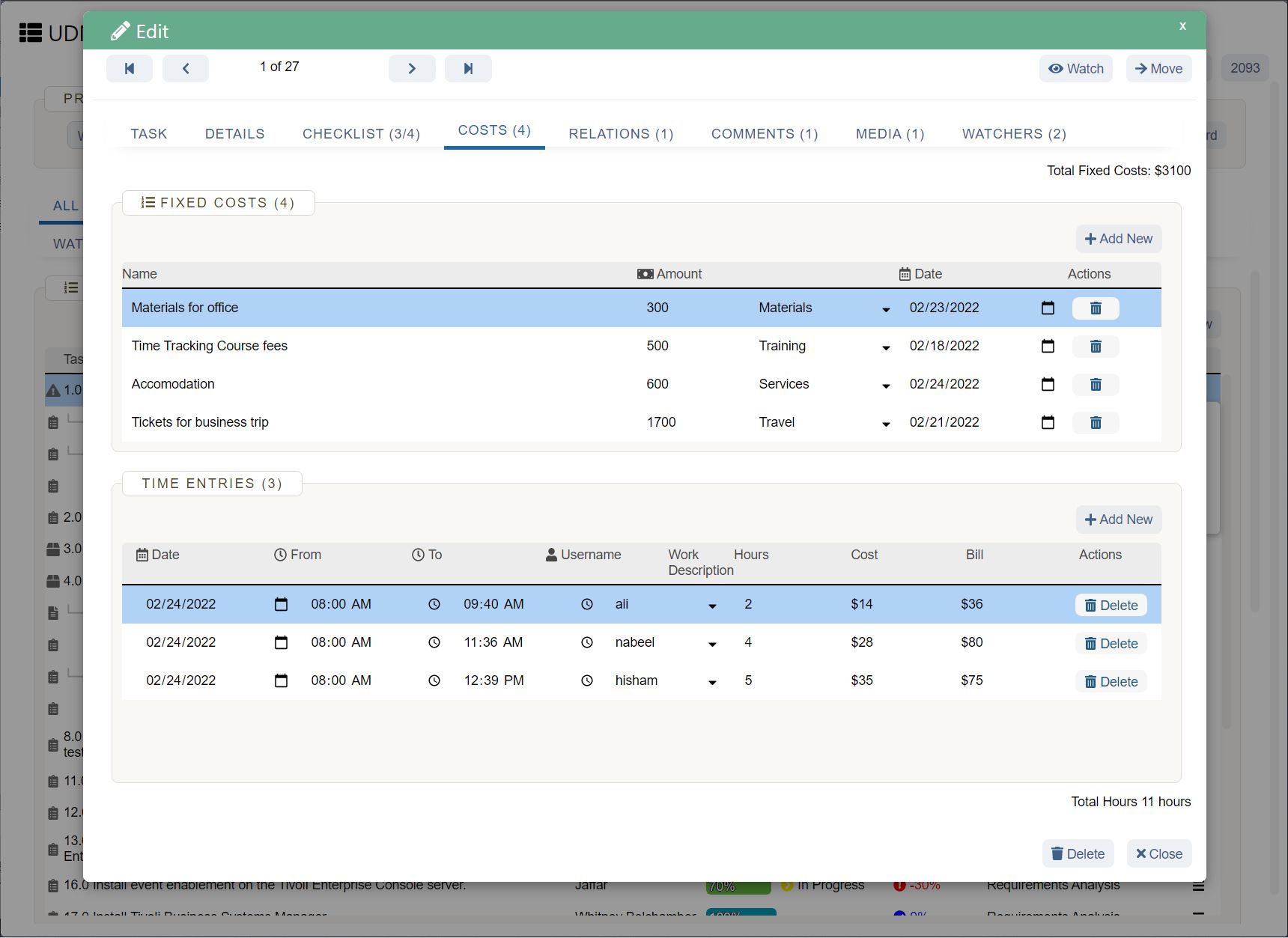

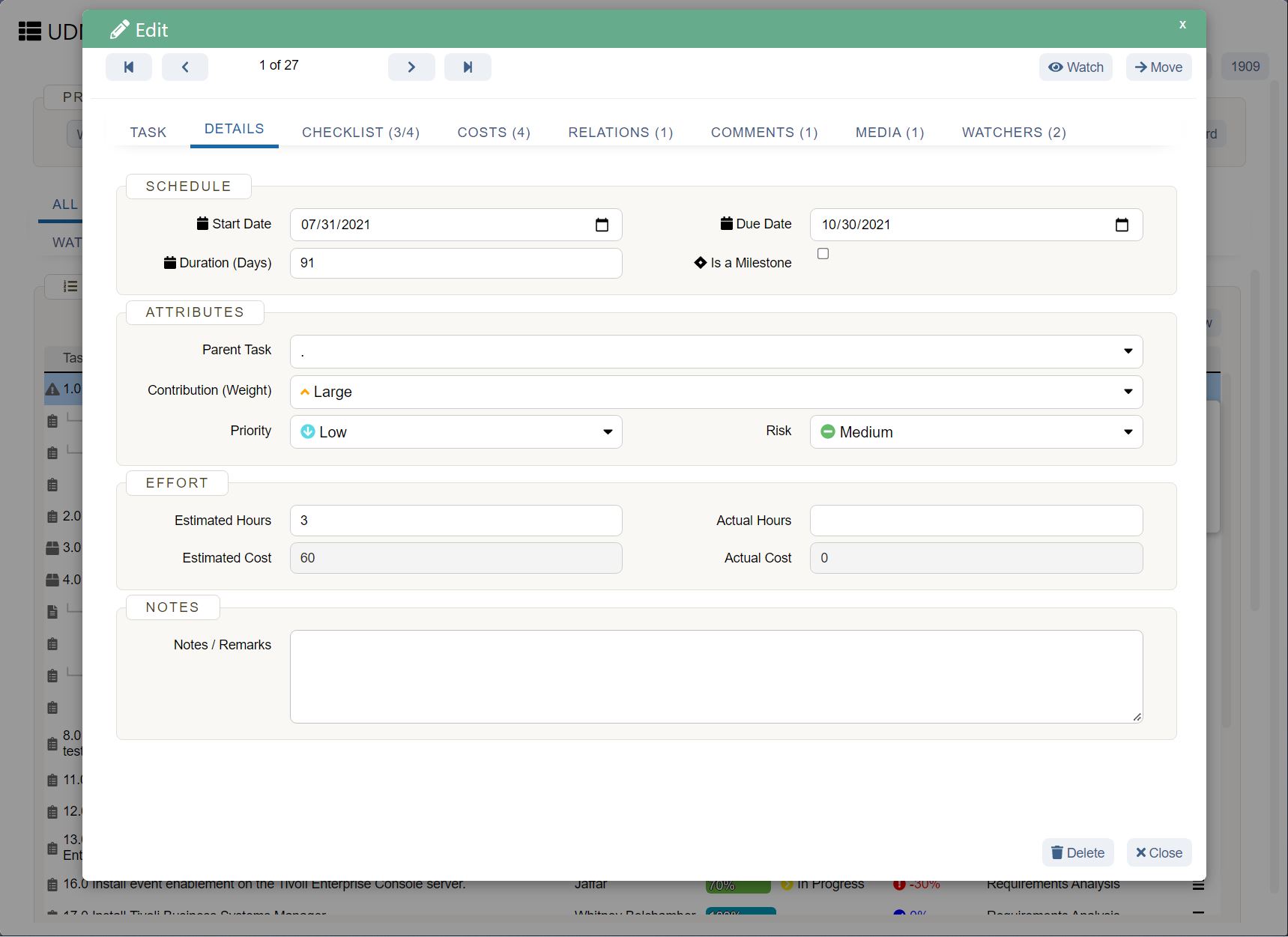

To start a project, you need to create a project charter , define its scope , identify your objectives, and bring relevant stakeholders on board. Next, break down the work into tasks and subtasks, setting due dates, allocating resources, mitigating risks, and estimating costs.

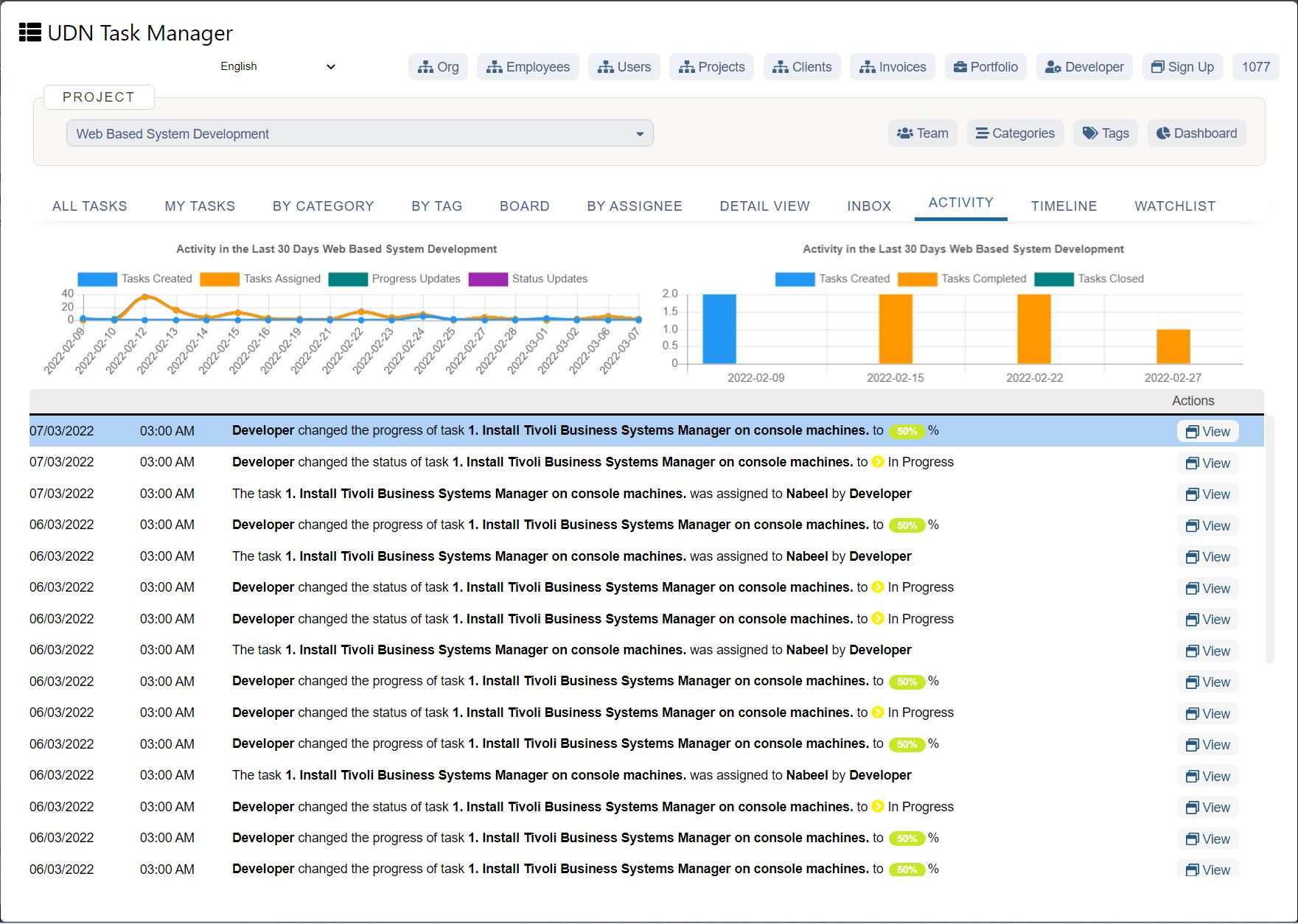

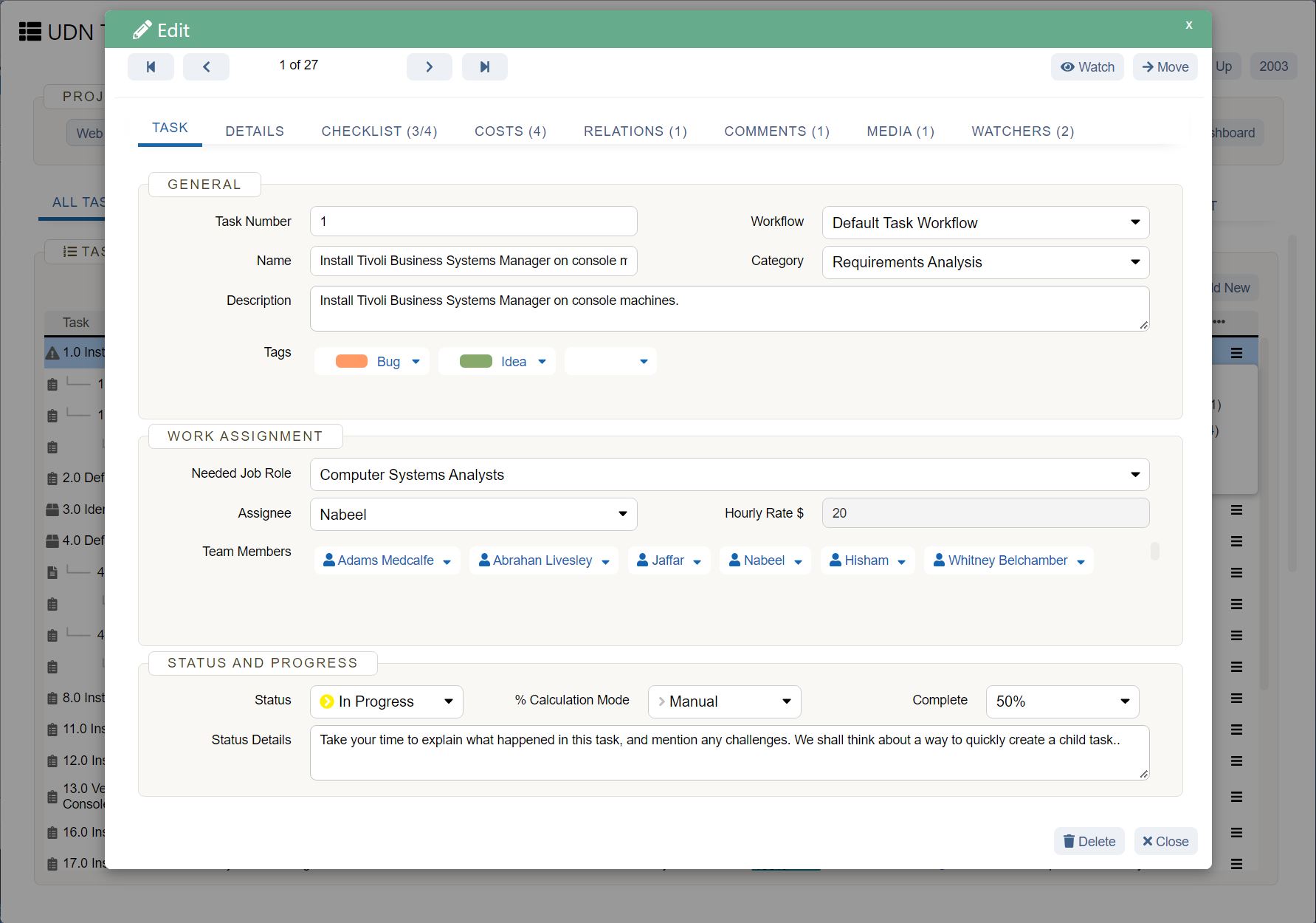

Then it's time to execute. Assign responsibilities within your team and create a single source of truth to communicate and collaborate in real-time. A collaborative workspace like UDN Task Manager provides a secure platform to achieve these and keep team members on track. Steps in a typical M&A project execution include:

M&A pre-merger project management tasks usually involve:

Pre-merger M&A project management best practices

In the pre-merger phase, project management best practices ensure sound decision-making and risk management. Best practices include:

Using a phase-gate process to manage M&A projects

Using the phase-gate process in M&A project management is a great way to organize and execute tasks in phases as you advance from one critical stage to the next.

The phase-gate process requires a review of each project stage before moving on to the next. Specific criteria must be met to determine the success of each phase. This helps the acquiring companies reviewing hundreds of potential M&A targets find the best deal. Setting clear criteria for what makes a target eligible enables you to maintain focus on your organizational needs and strategy.

Without defining clear parameters, your team may waste resources going after candidates that do not align with the M&A strategy. Typically, there are three main decision points in the pre-merger M&A phase-gate process:

Other pre-merger best practices

Other pre-merger project management practices are similarly aimed at making sure your deal is sound and has a good chance of success.

Key processes in post-merger M&A project management

Post-merger M&A project management focuses on:

Post-merger M&A project management best practices

The post-merger period builds the foundation for realizing the intended benefits of the M&A. Without post-merger project management best practices, missteps can ruin the partnership potential. Strong project management decreases your risk and provides you with a system.

Best practices for project management in the post-merger stage fall into broad categories:

It’s critical to carry along your team to tackle post-merger tasks with high productivity and engagement. Create a rewards strategy that combines growth opportunities, recognition, and benefits to incentivize employees to achieve post-merger goals.

Ensure your company's mission remains clear and communicate changes quickly, so your employees have stability amid the new developments. Make sure they understand the M&A rationale and how it ties into your original vision so that they can commit their best efforts to its success.

When it comes to people and culture-fit in the post-merger organization, tread prudently. Organize staff-related issues, e.g., planning for layoffs, creating a new corporate structure, assigning key responsibilities before moving on to the M&A integration plan.

Common M&A project management mistakes

According to a report in the Harvard Business Review, 70%-90% of M&A projects fail due to common challenges and mistakes. Here's a list of the most recurring mistakes M&A managers make:

Acquirers often push their ethos and culture without a healthy transition period for the acquired company. This causes chaos, disorganization, and low morale among employees. Underestimating and overextending staff and resources is another frequent mistake in M&A projects.

How to create a merger and acquisition project plan

Your M&A project planning process must be disciplined and comprehensive. The following are critical elements of the M&A project planning process:

How to create an acquisition plan

One of the errors many M&A managers make as they start a merger or acquisition is not putting together an acquisition plan. The acquisition plan guides the entire process and is a much-needed asset when planning M&A.

It creates a roadmap for what you want from the M&A and reassures sponsors that the merger or acquisition is thought-through and well-managed.

When writing your acquisition plan, ask yourself if what you're writing explains the M&A opportunity clearly. The format of the acquisition plan follows a similar structure as a typical business plan. Here's an outline of an acquisition plan:

Your executive summary should be concise, information-rich, and contained in no more than one page. Its goal is to sell the M&A opportunity as best as possible. Make sure to include your target market, business strategy, and summary financials. Investors may read only this page before skipping to the financial projections, so make sure it's strong.

This section outlines the target business and why it's worth what you're proposing to pay for it. Be as thorough as possible. If you see specific weaknesses in the business, talk about how you can iron them out and create value. Make sure to include:

The more granular the detail and relevant to your region this section is, the better. Answer the following questions:

This section covers sales for the target's products and services. It should compare their pricing strategy to yours and show how both companies conduct marketing.

This section is the one that can make or break the deal. You should be as thorough as possible, reviewing and assembling the target's past financial performance. Typically, this should involve at least three years of financial statements and tax returns. Each one should be comprehensive and honest, having supporting documents where needed.

Raise any issues which may conflict with your business, e.g., different credit arrangements with customers. You should also look at projections for the business. Going through the past and projections sections is a useful exercise to summarize where you will make gains or losses from the merger or acquisition.

This is a brief section showing how the business will move from the control of the current owners to the post-merger owners. This section should detail how sales relationships, contract agreements, and intellectual property will be dealt with in the post-merger organization. Minimize the chaos that can come with transitioning the organization by getting this section right.

This section shows the financial structure you will use to acquire the target company.

This should include copies of tax returns, compliance licenses, and receipts, including auditors' letters and other relevant legal documents.

While there is room for variation in sections of each business plan, every plan should convince the reader of the merits of the merger or acquisition. Each section should be compelling, relevant, and detailed.

How UDN Task Manager can help with M&A project management

M&A experts recommend using project management techniques to organize your tasks from the beginning when exploring potential deals until you fully complete an M&A transaction and start integrating both businesses.

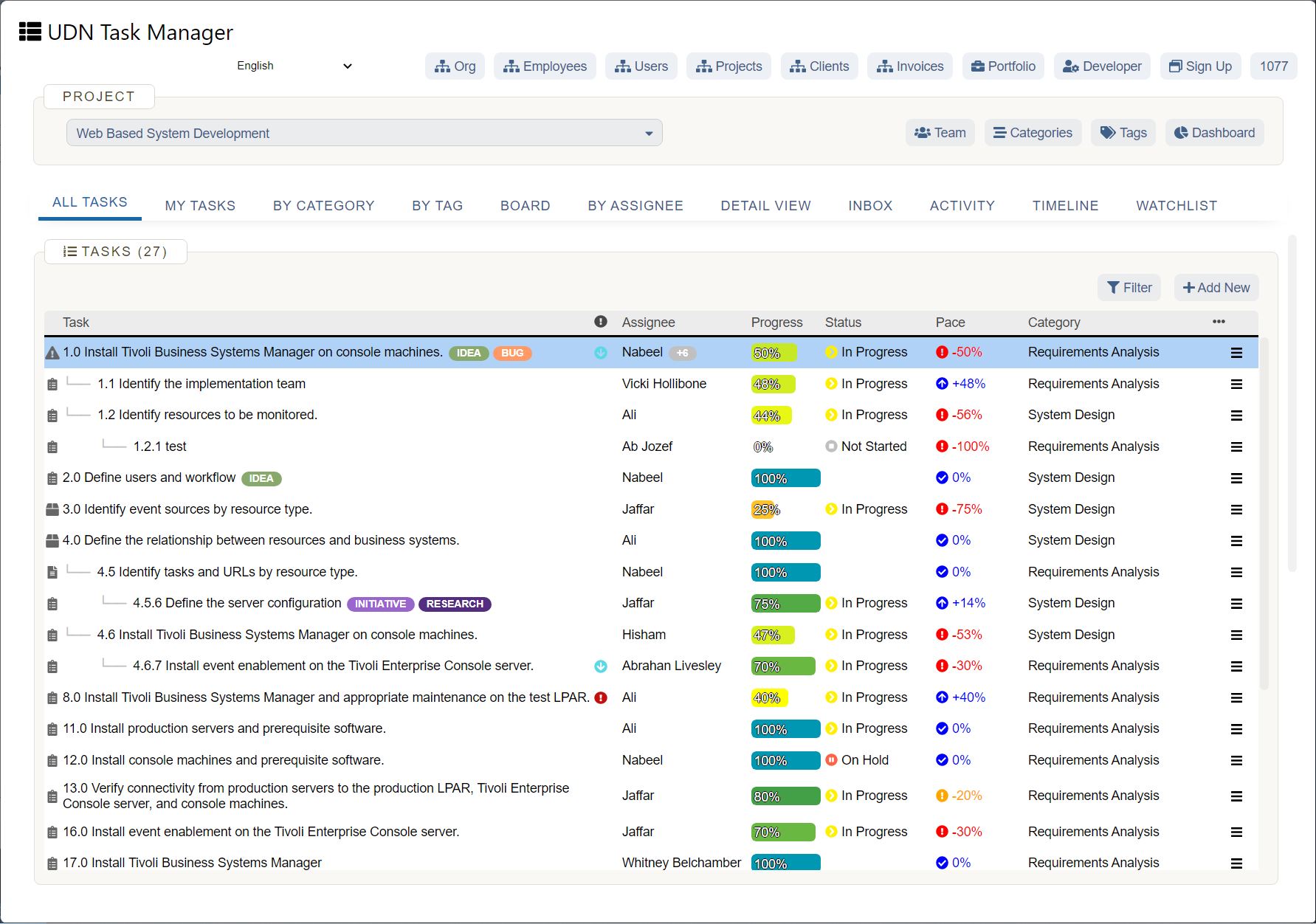

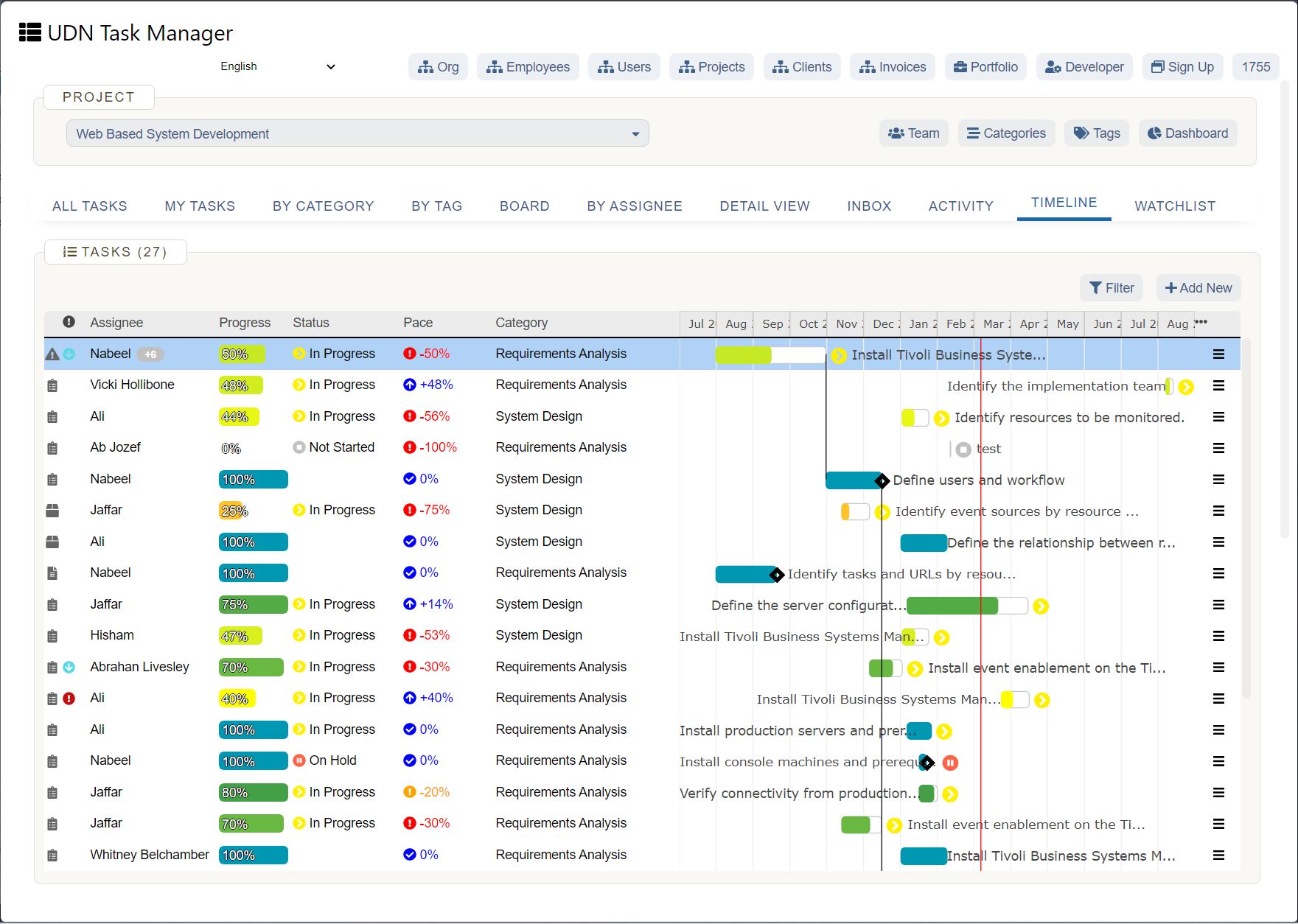

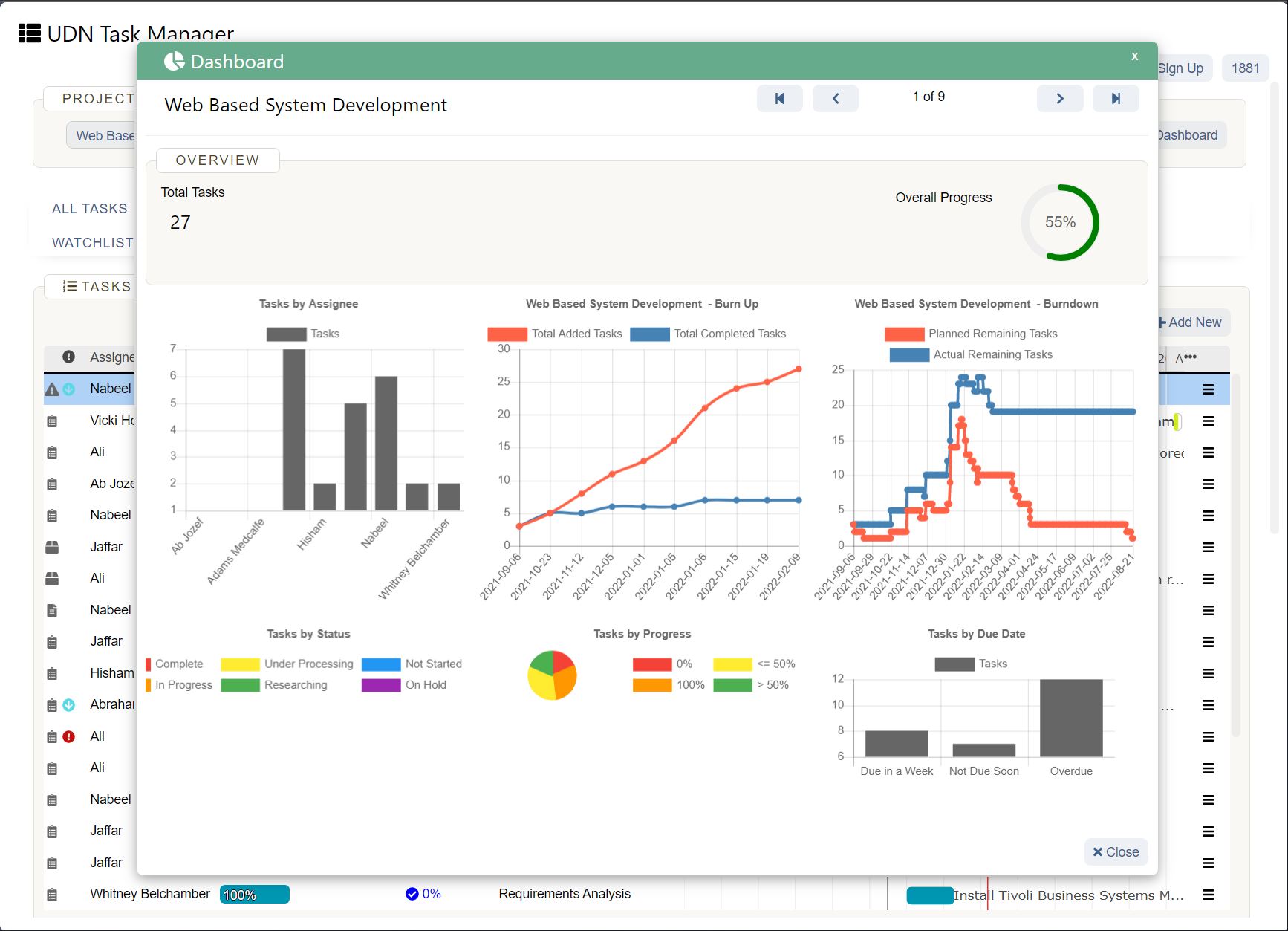

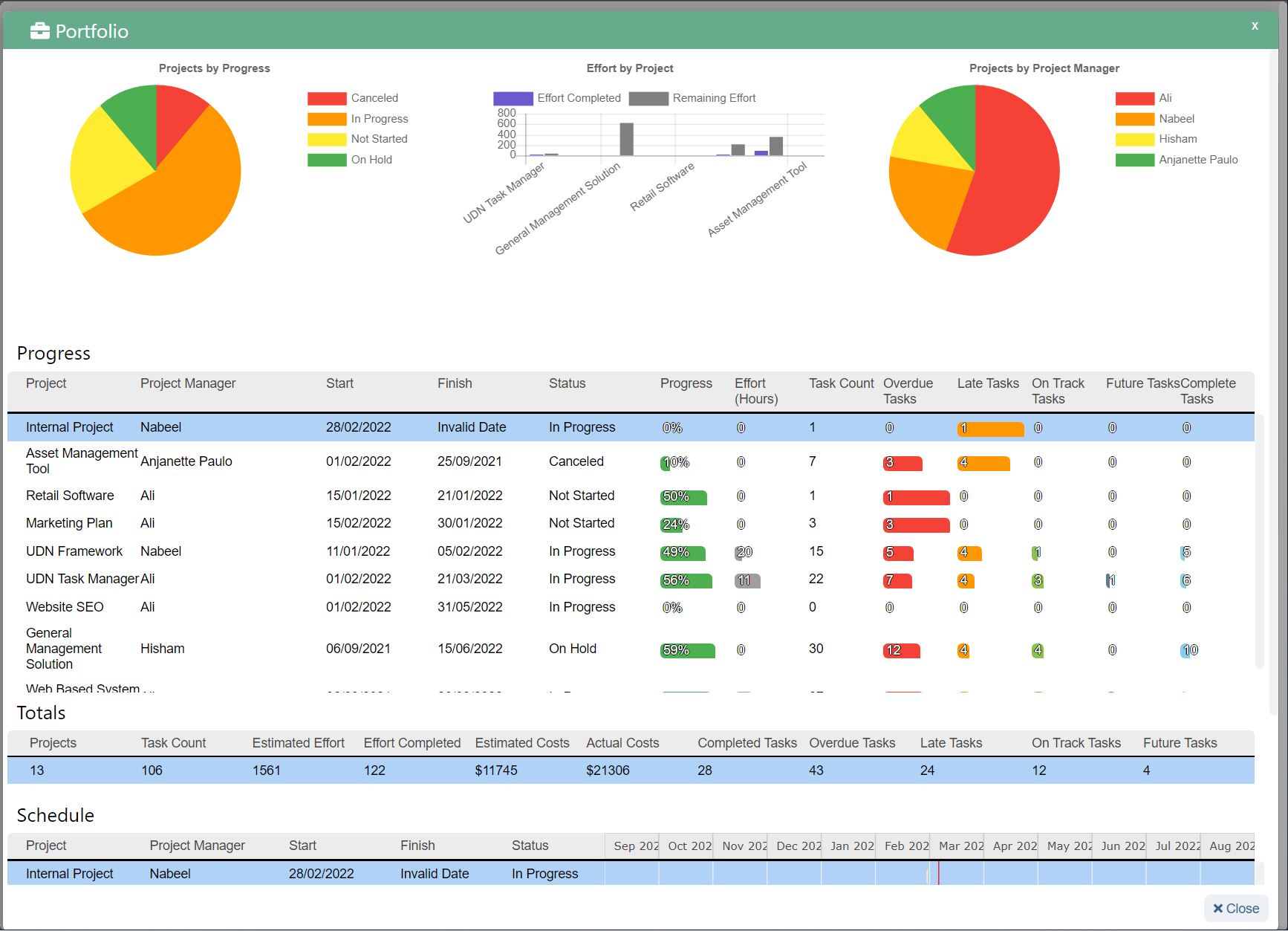

UDN Task Manager helps M&A executives and project managers communicate and collaborate in real-time, manage information flows and workflows, get approvals and signatures, maintain deep visibility, and extract insights from different sections of the acquisition plan and ongoing projects.

This collaborative approach with UDN Task Manager minimizes chaotic work, misalignment, and scattered collaborations in the post-merger organization. Try UDN Task Manager 's project management software for free with a two-week trial .